Welcome to my free cryptocurrency educational series. Each part builds on the previous ones, so I suggest starting at the beginning and moving through part by part:

Cryptocurrency 101 series (core principles, social justice, blockchain tech, Bitcoin):

- Part 0 Overview of my series, who this is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t.

- Part 1 Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

- Part 2 How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world)

- Part 3 How the blockchain keeps running, where new Bitcoins come from (i.e., how mining works), and concerns about Bitcoin’s environmental impact

- Part 4 How crypto offers autonomy, why it can’t be stopped, and the value of decentralization

- Part 5 How to store and use cryptocurrency, some basic cryptography, how wallets work, identity management, and the future of democracy

- Part 6 Overview of the different types of wallets, which one is best for you, what to be careful of, and why a hardware wallet might be worth the investment

Cryptocurrency 201 series (intermediate principles, Ethereum, NFT’s, DAO’s):

- Part 7 Ethereum (the #2 most popular cryptocurrency, and the one I’m most excited about), smart contracts, dapps, gas (and the high gas fee problem), Proof of Stake (PoS), and Ethereum 2.0

- Part 8 Coins vs. tokens, and some real Ethereum use cases—oracles and DEX’s

- Part 9 Intro to NFT’s (collectibles, research funding & historical significance, and music)

- Part 10 More categories of NFT’s (art, video games, virtual reality)

- Part 11 Wrapping up NFT’s (what you can actually do with them, upsides, downsides, risks)

- Part 12 DAO’s (organizations managed by algorithms, governance tokens, collective ownership, and the “network state”)

Cryptocurrency 301 series (advanced principles, DeFi, reinventing the finance world):

- Part 13 DeFi & CeFi, reinventing banking with peer-to-peer finance, stablecoins, and borrowing & lending

- Part 14 More DeFi (how Uniswap works, plus insurance, payments, derivatives, blockchains, exchanges, liquidity staking, and impermanent loss)

- Part 15 Wrapping up DeFi (why liquidity is important, LP tokens, yield farming, calculating return, yield aggregators, and major risks)

Cryptocurrency 401 series (investing, making money in crypto):

- Part 16 Intro to investing (what could go wrong, where you might fit in, and what kind of investing could be right for you)

- Part 17 Preparing to invest (how much money to put in, how to split it up to mitigate risk, setting up your wallets, buying the coins & tokens you want, and dealing with different blockchains)

- Part 18 More preparing to invest (security, understanding what price targets are realistic, and using “expected return” to choose between opportunities)

- Part 19 Specific investing options (buying and holding, index tokens, leveraged tokens, my list of coins and tokens, mining & staking, and lending)

- Part 20 Higher-risk, higher-reward opportunities (liquidity staking & yield farming, NFT’s, OlympusDAO, and Tomb Finance)

- Part 21 The single investment that’s made me the most money: StrongBlock

- Part 22 Wrapping up my seven categories of investment (including an update on StrongBlock)

- Part 23 How to invest depending on how much money you have (plus, the market dip, where my money is, and how to fit crypto into a larger investing strategy)

- Part 24 Holding coins & tokens vs. yield farming, where I’m putting my money now, big news on StrongBlock, and the future potential of crypto

- Part 25 Staying safe, preparing your taxes, avoiding scams, upgrading your security, and judging new projects

- Part 26 How to decide who to trust in the crypto world, technical analysis & market cycles, and an update on my longish-term portfolio

This is part 1 in my cryptocurrency educational series.

(Updated on June 16, 2021—split some of part 1 off into part 0)

Part 1 Reading Time: 26 minutes

Want to listen to this post instead?

Warning from future-Michael:

Hi there! Thanks so much for starting my crypto series.

This first post was written back in April, 2021. I’m writing this addendum in October, 2022.

I still very much believe in the future of crypto, despite the current market slump. But my warning to you is this: The crypto world changes very quickly. Innovation is extremely quick.

So, please keep that in mind as you read through this series. Most of what I wrote a year ago is still relevant and true (especially the more philosophical and foundational ideas behind how crypto works and why it’s useful).

But, once I start getting into crypto investing later in this series, I encourage you to be warier. Some of the strategies and coins/tokens I recommend will still make sense, and others will be totally out of date. So, please do your own research and don’t just blindly replicate the strategies I was using months ago.

Thanks for reading, and I wish you luck on your crypto journey 🙂

Why should you care about crypto? What’s in it for you?

There’s a lot here, but I believe it’s worth the effort to learn. Here are three big reasons I’m excited about it:

- The awesome technology and fascinating innovation happening in the developing crypto ecosystem.

- The tech behind cryptocurrency has the potential to change the world. Right now is just like back when the original iPhone was announced—when we went from phones that could run simple, unintuitive, proprietary “apps” to an era of hundreds of thousands of sophisticated, desktop-quality apps being available. Crypto technology is likely going to have a similar level of impact. This genuinely feels like the next big thing to me—it’s hard to predict exactly where this will all go, but it feels important to follow and understand.

- The potential for improving the world in terms of social justice, individual empowerment, and creativity.

- This isn’t just about technology. It’s about a potential major transition in power from huge, “too big to fail” financial institutions to distributed, decentralized financial structures with more access for everyone, less bureaucracy, and more accountability.

- Furthermore, there’s a lot of really cool innovation happening in the creative space around crypto—related to art, video games, collectibles, online worlds, and more—both in terms of compensation/ownership for artists/creators as well as brand new forms of art developing.

- (By the way, I care a lot about climate change too, so if you’re worried about crypto’s environmental impact, I’ll be covering that in my third post in this series.)

- The financial opportunity—on the low end, we’re talking about keeping your money safe from inflation in a way that traditional banks can’t match; and, on the high end, we’re looking at the possibility of making a lot of money (of course, you could easily lose it all too if you’re not careful!).

- Bitcoin has had a rate of return of 100% this year alone—yes, since January 2021. Ethereum is up 295% since January. Yearn.finance, a popular crypto lending platform, is currently providing 15% APY (compared to the 0.06% APY offered by the very best traditional savings accounts right now—yes, that’s a difference of 250x).

- Let’s get one thing straight, though: We can’t expect that kind of growth to continue, at least in such a short span of time. The ship has already sailed in some ways, and it’s very dangerous to see crypto as a way to get rich quick (i.e., it’s insane to put your life savings into Dogecoin, even if you have a friend of a friend who tripled their money).

- Even so, there’s likely a lot of room for money to be made if you put in the time and effort to really learn about this stuff. The truth is that the market is likely to crash many times in the coming months; but, if you’re willing to hold your crypto for years, then a lot of smart people think you’ll get an excellent return on investment. This is a volatile space though, so it will be a bumpy ride.

- Again, please don’t try to time the market to make a quick buck—you’ll most likely fail. Seriously, in early 2018 it looked like Ethereum was skyrocketing. Then it declined 72% in just 3 months (of course, it fully recovered and then rose to over twice that former peak value, but that took three and a half years).

- So, please be careful. And the best way to do that is to educate yourself on how this stuff actually works (so, hopefully you’re in the right place!).

Don’t beat yourself up for being late to the party.

I’d seen Bitcoin in the news many times over the years.

I’d thought about buying some. But it always seemed too complicated, or I worried it was a pyramid scheme or a speculative house of cards that could fall apart at any moment.

I remember back in the early-mid 2010’s when I seriously tried to buy a little Bitcoin, just in case it got big. I was ready to spend $50 or $100, but I remember that the concept of “wallets” felt overwhelming. Should I use a web-based one? Did I need to set up some complicated software on my computer?

I gave up.

And, of course, that $100 would have been worth around $15,000 today.

But here’s the thing: It’s always easy to look back with hindsight and feel foolish. And more importantly: Would you have held on all this time?

Sure, investing back then would have been nice, but I believe that now is still an excellent time to get into crypto.

Try not to beat yourself up for not getting in sooner. I did that for years, and then I realized something: It’s easy to imagine that I would have held on to my $100 investment until it turned into $15,000, but I probably wouldn’t have. I probably would have sold when it doubled to $200, or certainly when it went up 10x to $1,000.

So, I’d still be kicking myself now for selling too soon.

Be careful where you get your financial advice.

Please don’t get sucked in by all the “gurus” on YouTube.

They specialize in making you feel a sense of urgency: Time is running out, and you need to get in RIGHT now (“here are the 5 tips you NEED to know to make MILLIONS in crypto”).

Take your time. Learn how this stuff works. There will be bumps along the way. And if you actually understand this technology, it’ll be a lot easier to feel confident during down markets that things will work out.

I think I can save you some painful missteps.

Like I said, I’d been thinking about all this for years, but I really started diving in only a few months ago. Since then, I’ve read hundreds of articles, Tweets, and Reddit posts; I’ve listened to quite a few podcasts; and, I’ve made many mistakes along the way.

This is all fresh and I’m still very much learning, but this is what I wish I’d known when I got started.

Why is cryptocurrency important and useful? Here are 10 reasons.

There are a lot of problems with our current financial system (and society). Crypto might be able to help.

1. The major banks, financial institutions, and tech giants have too much power (and immunity).

We’ve seen time and time again that big banks cause harm to ordinary people (e.g., leading to the 2008 financial crisis), but they’re not held accountable. We need a different system for managing our money, getting loans, etc. As the saying goes, banks have become too big to fail.

Instead, we need a decentralized financial system where all the power isn’t in the hands of a small group of elites.

And, here’s an example related to the tech giants: Google’s entire business is built on online advertising. If you’re using Chrome (what many tech enthusiasts have believed to be the best browser), Google tracks and logs all sorts of things about you. That way, they’re able to sell you targeted ads, even if you’re not on a Google-owned website. But, this arrangement isn’t great for users (privacy concerns, and most ads aren’t fun to look at) or even for the companies paying Google to show their ads (many people run ad blockers nowadays).

A relatively new browser called Brave is looking to change that. It’s built on most of the same tech as Chrome; so, it feels familiar, and all your usual extensions work. But, it’s designed to be secure and private—no spying on you. What’s even cooler is that it has cryptocurrency tech built right into the browser. There’s a lot to talk about here, but the short summary is that you can choose to allow ads on sites you want to support, and you’ll be compensated in cryptocurrency, which you can either keep yourself or use to “tip” content creators and companies you want to support. In other words, this allows you to develop a consensual relationship with a company rather than just being annoyed when you’re forced to see their ad.

2. Our current financial system is not equitable, and it’s full of bureaucracy that makes it hard to use.

People with lower incomes are taken advantage of with predatory loans, high fees, and so on. If you have a poor credit history through no fault of your own (e.g., systemic structural racism), you’re often unable to get mortgages, and getting your financial needs met is more painful than it should be.

We need a system where everyone has a fair shot. We need a way to break the cycles of poverty in marginalized populations.

And, even more simply, we need ways of dealing with money that are simpler and more approachable. Most banks are only open certain hours that don’t work for a lot of people, and they have all sorts of requirements and hoops to jump through that are intimidating or impossible for many people to meet.

Think about developing countries too. Venmo is easy to use in the United States, but it requires both the sender and receiver to have a bank account. In developing countries without a lot of modern infrastructure, that’s a high barrier to entry.

What if there were something like Venmo, but it didn’t require banks?

3. Transferring money between countries is way too expensive; plus, it’s slow, cumbersome, and sometimes affected by corruption.

We need a way for people to more cheaply and easily send money to loved ones or business partners outside the United States.

And, with so much work happening online now, we need a way to pay people in other countries more easily for the work they’re doing over the Internet.

For example, more and more people in India are getting the education they need to rise up out of poverty and do knowledge work online (e.g., software development or testing). More opportunities will be available to them from all over the world if there’s an easy and cheap way to pay them for small jobs rather than relying on the expense and bureaucracy of international wire transfers.

Here’s an excellent article with a very clear proposal for implementing this at scale in India.

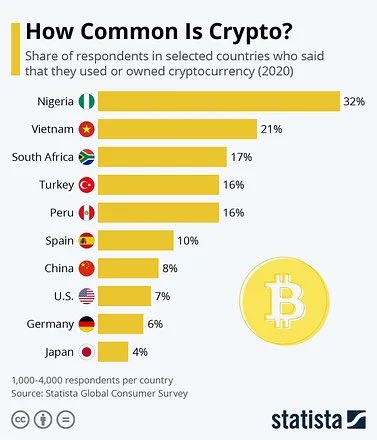

Cryptocurrency is a global phenomenon, and it’s already being used a lot more outside the United States (more on this further down this post):

(source)

(source)

Another important point here is donations and aid to less-developed countries: “Digital currencies and the blockchain technology they use could cut down on aid lost through local corruption, Rendon [a fellow at the Center for Strategic and International Studies] said, referencing a 2012 speech by Ban Ki-moon when he was secretary general of the United Nations. Ban said corruption prevented 30 percent of the U.N.’s development assistance from reaching its final destination the previous year… GiveDirectly reported about $30 million a year in direct grants in 2016 and 2017. About 2 to 3 percent of the organization’s total budget gets eaten up by fees charged for banking services, exchanging currency and fees for mobile money systems like Kenya’s M-Pesa, Huston said. In theory, the organization could bypass those systems and fees through cryptocurrency, he said.”

4. Misinformation and oppression are some of the most pressing problems in the world right now.

What sources can you trust? We need a way of keeping track of what’s actually true and recording it in a record that can’t be altered in the future, no matter who is in power. And, to combat oppressive regimes, it’s important to have platforms available that can’t be censored (including financial transactions being blocked).

Here’s a cool example of a crypto-based app being built for whistleblowers. It allows people to submit information—including images, files, and locations—in a way that can’t be censored, traced back to them, or modified by anyone (even the organization who created the app) after it’s been posted.

5. We should strive to keep improving security and transparency.

Whether we’re talking about voting machines, smartphone apps, or banking, it’s been proven time and time again that open-source projects are more secure (i.e., platforms where the programming code is made available for anyone to examine).

Compared to hidden proprietary platforms, open-source software has fewer bugs and security vulnerabilities because more people are examining it. Issues can be quickly fixed by anyone rather than waiting on a small team to follow bureaucratic procedures and fix it themselves.

Which would you trust more: a bridge that had been inspected by multiple independent engineers or one built by a construction company that kept all its construction details secret?

Here’s a concrete example that just happened: Someone was using his PayPal account to pay for Tor nodes to avoid country-level censorship. His account was shut down by PayPal with no explanation and no ability to contest the decision.

He got lawyers from the Electronic Frontier Foundation involved, who found “no evidence of wrongdoing that would warrant shutting down his account”; and, they felt “deeply concerned that Brandt’s account was targeted for shut down specifically as a result of his activities supporting Tor.” But, PayPal refused to offer any clarification or to revisit their decision. In other words, there was zero transparency into their process.

In contrast, as you’ll see in a future post about Ethereum and smart contracts, crypto is built around a core principle of transparency. With crypto-based smart contracts, all the specific rules and policies are written right there in the code for anyone to see.

6. The digital world is becoming increasingly important, and there’s so much room for creativity in the digital art space.

Many of us spend a lot of time now in virtual worlds, and a lot of people put a huge amount of time and energy into creating digital assets and personas. The work of those artists and creators should be properly attributed and protected, and they should be compensated if it’s being used and enjoyed.

Why should a traditional painter get to sell their piece of art for a lot of money, but a digital artist who puts in just as much time and effort can have their work easily copied without being paid?

Beyond the compensation piece, the technology behind crypto also allows for exciting new types of art and collectibles, which I’ll get into in a future post. As a quick preview, imagine programmable art that changes based on conditions (e.g., a landscape painting in a digital frame on your wall that changes to be rainy when it’s raining outside).

7. With increases in technology, our money should be smarter.

The world of finance has evolved a lot in recent years—now we have things like PayPal, contactless payments at stores, and stock trading on our phones.

But all that is still based on paper money. Stores still need cash registers, and money that falls out of your pocket is still lost forever.

Wouldn’t it make more sense in 2021 to be able to “back up” our money and have it feel more secure?

8. We need a way to protect our savings from inflation.

What’s inflation again? To put it simply, as the value of the US dollar decreases, goods and services cost more. Inflation tends to go up when the government prints money, and our government did a lot of that during the pandemic.

There are many different opinions out there about how dire inflation is going to get in the US. Some experts believe that we’re headed toward a crisis point and others believe that those fears are overblown.

I’m certainly not savvy enough in economics to sort out who’s right, but here are some things that are clear to me:

- The purchasing power of the dollar keeps decreasing. Things cost more now than they used to.

- Savings accounts are largely useless nowadays. In the past, you could put your money away in a savings account or certificate of deposit and earn around 5% interest. Today, the very best accounts offer only 0.6%.

- Even if inflation turns out to be under control in the US, it’s definitely not elsewhere in the world: It’s 25% in Argentina, 24% in Egypt, 14% in Ukraine, 11% in Turkey, and 6% in Mexico. In other words, there’s a great need in the world for an easily-accessible currency that can beat inflation.

9. We probably shouldn’t let China lead the way here.

A lot of smart people believe that digital currency is the future.

China already has a head start. Just this month, they began public testing of the Digital Yuan, the first digital currency officially issued by the government of a major economy.

Imagine if China had been the country to invent the Internet rather than the United States. The US is not perfect by any means, but it at least doesn’t have as blatant a policy of censorship and top-down control as China does.

So, the faster the rest of the world embraces alternatives to the Digital Yuan, the more easily we’ll be able to ensure that the future of finance is based on openness, transparency, and accessibility.

10. We need somewhere to put our money where it can grow in value.

It’s hard to know what to trust nowadays: As the US government keeps printing money, there’s an increased risk of inflation on cash. Stocks are somewhat better, but there are some important issues there:

- The stock market has become skewed: The S&P 500 index is supposed to represent the top 500 companies in the country, but just five big tech companies make up 15% of the value of that index (so if they crash, the whole market will follow).

- Nowadays, a large percentage of stock trading is done by machines—algorithms that operate far more quickly than humans.

- Those algorithms react extremely quickly to any news from the real world. For example, they might decide to suddenly buy or sell a large quantity of some stock because of something in the news.

- As time goes on, that kind of trading will only increase, and it will get faster and faster to the point that the human operators will often be confused about why the trades are happening.

- It’s easy to imagine that, with the Internet, the future should become more linear and predictable thanks to the easy spread of information. But what’s actually happening in the stock market is greater volatility because these algorithms react so quickly to news, leading to sudden large market moves.

- Many stocks have gotten far too expensive for the average person to buy. For example, a single share of Alphabet (Google) is over $2,000, and a single share of Tesla is over $700. Even if someone strongly believes in either of those companies, they might not have $700 to spend. It would be more approachable if it were possible to buy fractional shares (e.g., 0.01 shares of Tesla).

- Finally, the stock market is at historic highs and due for a correction (downturn), and it’s not even clear anymore if the US market is the most promising for stocks long-term (compared to quickly-growing economics like China, India, etc.).

That big list is promising a lot.

I want to be clear that it’s by no means proven yet that cryptocurrency will be able to deliver on all that. But I’m finding it fascinating to follow this community as it continues to make progress toward those lofty goals.

And in the meantime, some real use cases have already been delivered that I’ll get into in future posts (e.g., things like decentralized loans, some very interesting applications in the art world, and some additional financial use cases I’ll get into below).

What about crypto’s critics who say Bitcoin is just a game with no real value? Let’s dive a bit deeper into how cryptocurrency supports social justice.

It’s common for the mainstream media (and people working in the traditional finance industry) to dismiss cryptocurrency as delusional and not grounded in any real use case.

I believe this is a combination of two things:

- It can be incredibly hard to wrap your head around how crypto works and what it can do for the world. It took me months of reading for the magnitude of all this to really set in.

- Crypto threatens existing power structures. We all know the degree to which politics and power are controlled by money. Currently, large financial institutions hold an amazing amount of power, which is why they still haven’t been properly punished for their role in the last financial crisis. Crypto will loosen the tight hold that these institutions have on us by replicating all their services but in a way that’s more accessible and less predatory.

I’m going to drop in a very important quote here from an excellent article on financial privilege by Alex Gladstein:

“The critics cited above are all wealthy citizens of advanced economies, where they benefit from liberal democracy, property rights, free speech, a functioning legal system and relatively stable reserve currencies like the dollar or pound.

In reality, only 13% of our planet’s population is born into the dollar, euro, Japanese yen, British pound, Australian dollar, Canadian dollar or Swiss Franc. The other 87% are born into autocracy or considerably less trustworthy currencies. 4.3 billion people live under authoritarianism, and 1.2 billion people live under double- or triple-digit inflation.

Critics in the dollar bubble miss the bigger global picture: that anyone with access to the internet can now participate in Bitcoin, a new money system with equal rules for all participants, running on a network that does not censor or discriminate, used by individuals who do not need to show a passport or an ID and held by citizens in a way that is hard to confiscate and impossible to debase.

While Western headlines focus on Coinbase going public, Tesla buying billions of dollars’ worth of Bitcoin and tech bros getting fabulously rich, there is a quiet revolution happening worldwide. Until now, governments and corporations have controlled the rules of money. That is changing.“

Here are two more valuable quotes from that article to understand just how game-changing cryptocurrency will be for the world:

In Nigeria:

“62% of the population is under 25 years old… She credits Nigerians with being incredibly entrepreneurial. People do what they need to do to get by, and having a side hustle, she said, is natural. Part of this need to hustle relates to the country’s economic situation, where the official inflation rate now stands around 15%… Growing up, she saw people try to keep their money in dollars, or send it abroad or buy real estate. This was how Nigerians could protect the fruits of their time and energy, but only a handful had these options. Now, Bitcoin is changing the game, allowing more people to save like never before. Anyone with internet access now has an escape from their unreliable and exploitative national monetary system. Is it just helping the rich? Aderinokun laughed and said: this is not the case at all. It is providing employment, it is helping people convert their naira to other currencies, it is enabling commerce where it was not previously possible. With the Feminist Coalition, it helped people overcome financial repression and the freezing of activist bank accounts.“

In Sudan:

“The secret monetary police would spy on individuals, freeze bank accounts, confiscate assets and impose made-up fees on merchants. No reasonable suspicion was required. Mo calls it a system of national extortion… He said that the Sudanese who do already have smartphones have an extended responsibility to help others with their privilege. In his case, he has a large extended family that he supports. Where there were once financial walls cutting off Sudan from the world, Bitcoin has made bridges. It is now easy for Mo in Europe to send money back to his friends and family. What once took days now takes minutes. And he does not have to trust any third parties or require his family to deal with thieves in government.”

And, one more quote from another article by Alex Gladstein:

In October, a feminist coalition in Nigeria raised the equivalent of tens of thousands of dollars in bitcoin to buy gas masks and protest equipment as activist bank accounts were being turned on and off.

In Russia, the opposition politician Alexei Navalny has raised millions in bitcoin as Vladimir Putin maintains strict control over the traditional financial system. Putin can do a lot of things, but he can’t freeze a bitcoin account.

In Iran and Palestine and Cuba, individuals face sanctions or embargoes because of the misdeeds of their corrupt rulers. Bitcoin gives them a lifeline for earning income or receiving remittances from abroad.

Some Venezuelans, having watched their country’s currency evaporate due to hyperinflation, are converting their resources to bitcoin’s digital format and then escaping. With their savings secured by a password that can be stored on a flash drive, phone, or even memorized, they’ve started new lives in other countries, taking advantage of a technology that refugees throughout history could only dream about.

To wrap up, crypto has something for everyone:

- If you’re looking for promising investment opportunities and want to see your money grow, crypto should be very appealing to you.

- If you’re a libertarian or someone who highly values individual freedom, crypto should be right up your alley.

- If you’re a tech enthusiast who enjoys learning about new technologies that are just reaching their tipping point of more widespread interest and adoption, crypto might be for you.

- If you’re a futurist or social justice advocate wanting the world to transform to be more fair, equitable, and open, crypto should be very exciting.

Ready to learn how this stuff works? Let’s dive into crypto: Part 2: How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world).

P.S. Crypto is one of my newest passions, but my overarching focus in life is personal growth and intentional living. Do you want help with challenges like confidence, decision-making, or idea overwhelm? I’m a transformation coach who helps analytical thinkers get unstuck, find consistent motivation to take action, and design their life purpose. Read more about me here or my coaching practice here.