Welcome to my free cryptocurrency educational series. Each part builds on the previous ones, so I suggest starting at the beginning and moving through part by part:

Cryptocurrency 101 series (core principles, social justice, blockchain tech, Bitcoin):

- Part 0 Overview of my series, who this is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t.

- Part 1 Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

- Part 2 How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world)

- Part 3 How the blockchain keeps running, where new Bitcoins come from (i.e., how mining works), and concerns about Bitcoin’s environmental impact

- Part 4 How crypto offers autonomy, why it can’t be stopped, and the value of decentralization

- Part 5 How to store and use cryptocurrency, some basic cryptography, how wallets work, identity management, and the future of democracy

- Part 6 Overview of the different types of wallets, which one is best for you, what to be careful of, and why a hardware wallet might be worth the investment

Cryptocurrency 201 series (intermediate principles, Ethereum, NFT’s, DAO’s):

- Part 7 Ethereum (the #2 most popular cryptocurrency, and the one I’m most excited about), smart contracts, dapps, gas (and the high gas fee problem), Proof of Stake (PoS), and Ethereum 2.0

- Part 8 Coins vs. tokens, and some real Ethereum use cases—oracles and DEX’s

- Part 9 Intro to NFT’s (collectibles, research funding & historical significance, and music)

- Part 10 More categories of NFT’s (art, video games, virtual reality)

- Part 11 Wrapping up NFT’s (what you can actually do with them, upsides, downsides, risks)

- Part 12 DAO’s (organizations managed by algorithms, governance tokens, collective ownership, and the “network state”)

Cryptocurrency 301 series (advanced principles, DeFi, reinventing the finance world):

- Part 13 DeFi & CeFi, reinventing banking with peer-to-peer finance, stablecoins, and borrowing & lending

- Part 14 More DeFi (how Uniswap works, plus insurance, payments, derivatives, blockchains, exchanges, liquidity staking, and impermanent loss)

- Part 15 Wrapping up DeFi (why liquidity is important, LP tokens, yield farming, calculating return, yield aggregators, and major risks)

Cryptocurrency 401 series (investing, making money in crypto):

- Part 16 Intro to investing (what could go wrong, where you might fit in, and what kind of investing could be right for you)

- Part 17 Preparing to invest (how much money to put in, how to split it up to mitigate risk, setting up your wallets, buying the coins & tokens you want, and dealing with different blockchains)

- Part 18 More preparing to invest (security, understanding what price targets are realistic, and using “expected return” to choose between opportunities)

- Part 19 Specific investing options (buying and holding, index tokens, leveraged tokens, my list of coins and tokens, mining & staking, and lending)

- Part 20 Higher-risk, higher-reward opportunities (liquidity staking & yield farming, NFT’s, OlympusDAO, and Tomb Finance)

- Part 21 The single investment that’s made me the most money: StrongBlock

- Part 22 Wrapping up my seven categories of investment (including an update on StrongBlock)

- Part 23 How to invest depending on how much money you have (plus, the market dip, where my money is, and how to fit crypto into a larger investing strategy)

- Part 24 Holding coins & tokens vs. yield farming, where I’m putting my money now, big news on StrongBlock, and the future potential of crypto

- Part 25 Staying safe, preparing your taxes, avoiding scams, upgrading your security, and judging new projects

- Part 26 How to decide who to trust in the crypto world, technical analysis & market cycles, and an update on my longish-term portfolio

This is part 6 in my cryptocurrency educational series.

Part 6 Reading Time: 22 minutes

Want to listen to this post instead?

As we discussed last time, a wallet is where you keep all your cryptocurrency. It’s kind of like a physical wallet where you keep cash, except your cryptocurrency actually lives in the cloud—on the blockchain.

And at its core, a wallet is just a place that stores your private key and public key, to access your cryptocurrency that lives on the blockchain—including checking your balance, sending crypto, and receiving crypto.

Ok, how do I actually get a wallet? What do they look like? Which one is best?

Now we’re really getting into how this stuff works in terms of practical usage. So, in this post, I’ve highlighted some critical things in red. Please pay close attention to those parts.

Also, I’m going to refer to “Ethereum” a few times, which is the second most popular cryptocurrency after Bitcoin. It’s the one that I’m personally most excited about, so I have more knowledge about wallets designed to work with Ethereum (though most of them support Bitcoin and other cryptocurrencies too).

Finally, if you’re anything like me, when you read lists like this, you usually gloss over most of the options and skim down to the one that seems most promising.

That makes sense. But in this case, I encourage you to read through each option since they build on each other. And, there are details here that I think will really help you understand how some of the underlying concepts of crypto work.

Wallets come in a variety of forms.

I’ll describe the different types below, and then I’ll go over my specific recommendations.

Ok, here’s a list very roughly ranked from simplest to most complicated (and thus, roughly in most cases, from least secure to most secure):

- Exchange-Based Wallet: This is the default wallet type when you buy cryptocurrency on an exchange (i.e., an on-ramp/off-ramp—the place where you exchange a currency like US dollars for Bitcoin, Ethereum, etc.).

- Your exchange will automatically create a wallet for you when you buy cryptocurrency. They’ll put all the coins you buy into a wallet that lives on their server. So, you never actually see the private key.

- This makes things simpler but less safe for you since you’re totally at their mercy—if the exchange goes out of business or gets hacked, you could very easily lose all your money (yes, this has happened, though not on Coinbase, the exchange I personally use).

- That’s why there’s a common saying in the crypto community: “Not your keys, not your crypto”—in other words, if you don’t control your private keys, you shouldn’t think of it as your cryptocurrency; it’s more like someone else has told you it’s yours but not actually given it to you. (That said, companies like Coinbase seem pretty trustworthy to me personally.)

- Note that this is the only type of wallet on this list where you don’t control your private key. This type of wallet is referred to as “custodial” because you’re handing over custody of your money to someone else. (In contrast, all the other wallet types on this list are non-custodial.)

- Three of the most common exchanges are Binance, Coinbase, and Kraken.

- If you eventually decide to buy many different types of cryptocurrency, you might end up with multiple wallets across different exchanges since not every exchange supports every type of cryptocurrency.

- One more thing: Paypal and Robinhood are similar to exchanges, but they’re actually closed ecosystems. Not only do you not control your private keys on those platforms, but it’s actually impossible for you to move your crypto from your Paypal or Robinhood wallet to an external wallet. You’d have to sell your crypto (convert back to US dollars) to pull it out. So, I can’t recommend either Paypal or Robinhood for cryptocurrency.

- Memorized “Wallet”: You could simply memorize your private key and public key. That would be the “safest” in one sense since your keys would never be written down anywhere where they could be stolen. But, it would be incredibly dangerous in every other sense since you’d lose your money forever if you ever forgot your keys. These keys aren’t exactly easy to memorize either (here’s an example of a private key: E9873D79C6D87DC0FB6A5778633389G4453213403DA61F20BD67FC233AA33263).

- Paper / MS Word “Wallet”: You could write down your keys on a piece of paper or save them on your computer in Notepad or Microsoft Word.

- Writing down keys on a physical medium is safe as long as you keep that object safe. You don’t want your keys on a sticky note by your computer.

- Please do not store your private key on a Notepad or Word file on your computer. If someone hacks you (which is much easier and more common than you might think), they’ll likely search for crypto keys, especially since it’s common knowledge what format they’re in, how many characters they are, etc. It’s tempting to save your keys in a place that’s easy to copy-and-paste from, but there are much better options for that further down this list.

- Here’s a cool website where you can create a new Bitcoin paper wallet from scratch. Just move your mouse around to create randomness to feed the algorithm, then click the Paper Wallet option to print your new wallet plus some easily-scannable QR codes of your keys. That said, it’s an interesting option, but I recommend one of the other wallet types on this list that makes things a whole lot easier.

- Browser Extension Wallet: This is a wallet that runs in a browser extension.

- MetaMask is easily the most popular one. In my experience, it seems to be one of the most commonly-used wallets overall (especially for buying certain types of crypto assets like NFT’s, which I’ll explain in a future post). Here’s the Chrome extension.

- Web-Based Wallet: This is a wallet that runs in the cloud and is accessed via websites.

- This can actually be more secure than you’d think, but you have to be very careful to make sure you’re on the real website and not a scam one designed to look familiar. Always make sure the website URL begins with “https” rather than “http,” and look for the lock icon in front of it in your browser’s address field.

- MyEtherWallet (MEW) is the official wallet of the Ethereum platform. From their website, you can easily create a new wallet or plug in your private key to open up an Ethereum wallet that you created elsewhere.

- If it’s confusing to you that a website would be able to open up a wallet that you created elsewhere, remember that no wallet actually stores your cryptocurrency. A wallet is simply a private key + a public key that point to your transactions on the blockchain. This is why you can actually open your same wallet via different wallet apps (by using your key). For example, if I create a paper wallet and then open that wallet in MEW by entering my key, it doesn’t transfer any money—it’s more like each wallet is opening a different window of the same house to look inside.

- By the way, the MEW website doesn’t actually retain access to your private key. When you visit the site, your key is stored in an encrypted file on your computer. But again, be extremely careful with entering your private key on any website, especially any wallet that I don’t specifically mention in this list. You should pretty much never have to enter your private key anywhere unless you completely lose access to the wallet you’d been using.

- Wallet App: This is a wallet that runs via an app on your smartphone.

- I don’t have much experience with this category (since I use the Ledger app, which I’ll describe in #9 below); but, it seems like some popular choices here are Trust Wallet, Jaxx, and Coinomi.

- Desktop Software-Based Wallet: This is a wallet that runs via a piece of software that you install on your desktop or laptop. These are secure and easy-to-use, but the downside is that you can lose your money if your computer crashes or if it’s hacked or stolen. But, you can back up your wallet just like you would any other files.

- Node-Based Wallet: Remember that a “node” means a computer running the software that keeps the blockchain network running. Remember too that each node carries a complete copy of the blockchain on it. So, one of the most robust ways of holding your cryptocurrency is to turn your computer into a node and then directly connect to the blockchain that’s now living right there. But, this option won’t be right for most people since it involves technical complexity and a high monetary cost.

- Each cryptocurrency blockchain has official software that you’d run on your computer to turn it into a node and create a wallet. Just like with other wallets, that software would give you a private key and a public key. And, if you were mining on your node, any new coins you won would automatically appear in your wallet.

- Hardware Wallet: This is a physical device similar to a thumb drive that stores all your keys. Whenever you want to buy or sell something using cryptocurrency on your computer or smartphone, you have to connect your hardware wallet—usually via either USB or Bluetooth. Then, you typically have to press a physical button on the hardware wallet to confirm the transaction.

- The most popular options are the Ledger Nano and the Trezor.

- Both of those also come with phone apps and desktop software, so you get the best of both worlds: The convenience of a software wallet with the protection of a hardware wallet. Plus, both of these wallets can also integrate with MetaMask (the browser extension from #4 above). Some crypto websites don’t yet support Ledger or Trezor directly, but they do support MetaMask, so that can be a convenient way to get maximum compatibility with all the crypto use cases out there right now.

- Hardware wallets are more expensive and more work to use, but many crypto advocates believe that’s a small price to pay for security if you’re making a substantial investment in the crypto space.

- By the way, the more paranoid crypto lovers would tell you to order your Ledger or Trezor directly from the manufacturer since, theoretically, someone at Amazon could tamper with your new wallet before it’s shipped to you.

Personally, I use a combination of several wallets:

- My main wallet is a hardware wallet (the Ledger Nano X).

- Plus, I run the Ledger app on my phone and the MetaMask browser extension (connected to my Ledger) on my computer.

- Since I trade a wide variety of cryptocurrencies on multiple exchanges, I also use exchange-based wallets for some of my smaller holdings (to avoid the transaction fees of transferring cryptocurrency between wallets).

- Finally, I use a node-based wallet for the cryptocurrency I mine (Chia).

But, I’m way deep into crypto, so you can very much start with just one.

What does all this actually look like?

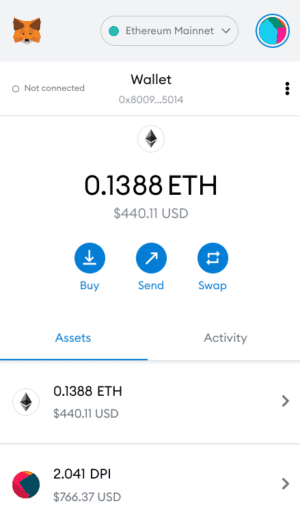

Here’s an example of what MetaMask looks like:

I’ll point out what you’re looking at:

- Under “Wallet,” you can see 0x8009… That’s this wallet’s public key on the Ethereum network.

- Beneath that, you can see that this wallet has 0.1388 ETH (Ethereum), which is currently worth $440.11 USD. From there, you can hit one of those buttons to send it to someone; or, you can hit Buy or Swap to be connected to one of MetaMask’s partners to buy more ETH or swap for a different cryptocurrency.

- Under that, you can see the list of cryptocurrencies in this wallet, which includes ETH as well as DPI (which I’ll get into in a future post on DeFi, or decentralized finance). For now, just think of ETH and DPI as two different types of digital money like Bitcoin.

- Finally, there’s an Activity tab where you can see a list of every single transaction that’s been processed through this wallet.

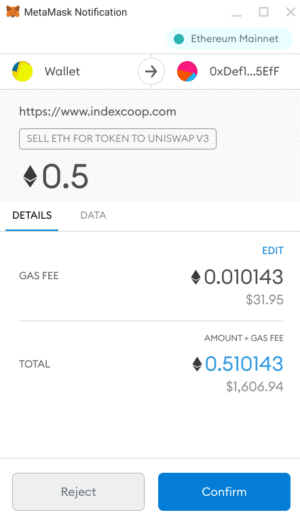

Here’s what it looks like to actually make a transaction with the MetaMask wallet—in this case, I tried using ETH to buy DPI via DPI’s website:

Here’s what’s happening there:

- At the top, you can see that I would be sending cryptocurrency from my Wallet to a wallet with the public key beginning with 0xDe…

- Next, you can see that the website I’m doing this on is indexcoop.com, and the transaction will be processed through Uniswap (which I’ll cover in Part 8).

- Below that, 0.5 ETH is how much I would be paying for the DPI I want. Then, it lists a gas fee of 0.01, so the total is 0.01 + 0.5 = 0.51 ETH (currently $1,606). I’ll get into gas fees in the next post (Part 7), but gas is basically just a transaction fee (that happens to be particularly expensive at the time I took the screenshot).

How do you actually get cryptocurrency into a wallet?

Your first step will always be converting US dollars (or whichever currency) into cryptocurrency via an exchange (on-ramp). There are many exchanges, but I like Coinbase Pro.

When you get on Coinbase Pro and buy some cryptocurrency, they’ll automatically create a new wallet and store your new coins in it. In fact, they’ll create a separate wallet for each type of cryptocurrency you buy.

But again, you never actually see the private keys with exchange-based wallets. All this happens behind the scenes. When you actually look at your portfolio of holdings, it will simply say you have 0.5 BTC, 1.2 ETH, etc. (even though each of those is technically stored in a separate wallet).

If you choose to use different wallets outside Coinbase, you’ll have to transfer your cryptocurrency from the exchange’s wallet to your personal wallet elsewhere. This is referred to as a “withdraw.”

One more thing: Not every type of wallet supports every type of cryptocurrency (since there are many thousands of them beyond Bitcoin). So, before you transfer cryptocurrency to a new wallet, Google it to make sure it’s supported.

Don’t worry: All this can feel intimidating at first (it did for me!), but it gets a lot more comfortable once you’ve dipped your toes in. My advice is to start slow—buy a little crypto, then transfer only a small amount to a different wallet. You probably shouldn’t try a transfer of $10,000 on your first try.

Ok, here are my wallet recommendations for a few different types of people:

- Are you only working with a small amount of cryptocurrency (say, less than 5% of your total net worth) and want to keep it as easy as possible? Just buy your coins on Coinbase Pro and keep them there. Yes, it’s possible something could go wrong, but Coinbase is a major publicly-traded company that puts a lot of care into security.

- Be careful: Other smaller exchanges might try to lure you in with promises of rewards or low fees; but, I highly encourage you to stick with only Coinbase (Pro), Binance, or Kraken until you’re more crypto-savvy (and even then, I wouldn’t keep more than a small amount of cryptocurrency in the wallets of other exchanges).

- Are you working with more money but aren’t super tech-savvy or don’t want to over-complicate things? Use Exodus as your Bitcoin wallet, and use the MetaMask browser extension for Ethereum and Ethereum-based cryptocurrencies.

- Are you working with a lot of money or highly value security? Get a Ledger Nano X hardware wallet and connect it to MetaMask.

- Are you super excited about getting deeply into crypto? Get a Ledger Nano X, connect it to MetaMask, then do more research and consider starting a node.

Personally, I started with Coinbase Pro; then, I chose to get a hardware wallet, and I haven’t yet felt the need to move to an actual node.

Here are a few reasons to consider spending the extra time and money to go the hardware wallet route:

With a hardware wallet, your cryptocurrency is completely under your control and separated from all exchanges and organizations.

This might not seem like a big deal since exchanges like Coinbase seem pretty trustworthy nowadays. But that wasn’t always the case.

Back in the early 2010’s, Mt. Gox was the largest Bitcoin exchange, handling over 70% of transactions worldwide. In 2014, over $450 million worth of Bitcoin went missing due to some combination of theft, fraud, and mismanagement.

It’s largely because of Mt. Gox that so many crypto traders today are afraid of leaving their coins in the hands of an exchange (versus withdrawing them into their own personal wallet whose keys they control).

A hardware wallet is a device 100% designed to manage cryptocurrency and keep it safe.

That makes it more secure than a computer or phone.

Think about why you put so much trust in your bank. You probably assume that their security is handled by experts who specialize in that field and use all sorts of specific technologies to protect your account.

In my mind, getting a hardware wallet is similarly putting my trust in experts who specialize in crypto security.

The software on the hardware wallet protects you from online scams.

Every single time you try to make a crypto transaction on your computer or phone, your wallet app will ask you to connect your hardware wallet and confirm it.

At least with the Ledger Nano X that I use, there’s an extra layer of security because the tiny screen on the hardware wallet itself will display the transaction. It’ll show you the public key that the money is being sent to or received from, along with the exact amount. Then, you have to physically press a button on the hardware wallet to confirm.

Why is that useful? Well, there are a lot of sophisticated “dark patterns” on the Internet in general, even outside the crypto space—for example, a scammer might build a webpage that looks exactly like your bank’s website. Then, when you enter your username and password, they steal it.

Here’s how a hardware wallet would protect you:

- Imagine you somehow find yourself on a scammer’s webpage that’s made to look exactly like a popular crypto investing platform (maybe someone posted the link on Reddit or Twitter, and you clicked it without carefully examining the URL).

- You start setting up a transfer of Bitcoin, and the scammer site tells you that 0.15 of your BTC will be sent to the investing platform. You hit the submit button on the webpage, and your wallet app on your computer asks you to connect your hardware wallet to confirm.

- The little screen on your hardware wallet shows a certain hash as the recipient’s address. Now, just to be safe, you decide to double-check that that’s the correct hash (since remember the hash is a scrambled representation of the recipient’s public key, and it’s impossible for a scammer to generate a legitimate hash if they don’t have the person’s real key).

- So, you open a new browser window and visit a blockchain tracker site like etherscan.io to search for the crypto investing platform you want to send money to. When you search for an organization on there, it will show you their hash address (for example, here’s Yearn’s—it’s listed as “Contract” on the right).

- Wait! The address it’s showing on etherscan looks different from the one being displayed on your hardware wallet, which means the scam site almost lured you into sending money to the wrong wallet. Luckily, you can now decline the transaction via your hardware wallet.

One more thing about wallets: They can be “hot” or “cold.”

Within the hardware wallet (or software/app-based wallet) category, you can also keep your wallet “hot” or “cold” (sometimes referred to as “online” or “offline” as well).

Hot means that you’re regularly connecting your wallet to an Internet-connected computer. This makes it a lot quicker to trade cryptocurrency since you can easily ok the transactions in real-time, as I described in the example above.

In contrast, keeping your wallet cold means rarely allowing it to be connected to the Internet. This is less convenient but technically safer—if the only copy of your wallet lives in a physical safe or a bank vault and never connects to the Internet, it’s virtually impossible for a hacker to ever steal your money. But, theoretically, each time you connect to the Internet, it opens up the possibility of being hacked, however small.

To balance safety and ease of use, some people keep the bulk of their cryptocurrency in a cold wallet and then periodically move smaller amounts for day-to-day transactions to a hot wallet.

Personally, though, most of my wallets are pretty hot and I haven’t yet prioritized going to the trouble of creating a completely cold one.

Again, never ever share your private key with anyone (or your seed phrase, which is just as dangerous).

Never put it in an email or a text message. Don’t save it on your desktop.

It’s literally the key to your bank account, and there’s no crypto police force to get your money back for you if it’s stolen.

There’s no password reset. It’s just gone.

So, once you’ve put enough money into crypto, the best practice is to keep backup copies of your private key in secure places (e.g., a safe in your house or a safety deposit box at a bank). In fact, some people decide to literally stamp their private keys into titanium to keep them safe in case their house burns down.

Yes, I’ll admit that I did that. It felt just a bit silly.

But also awesome 😆.

Thanks for reading this far!

This is the end of “crypto 101” and the core discussion of Bitcoin. But everything you’ve learned in this series so far will be important for where we go next.

From here, we’re going to dive into a cryptocurrency that’s much more interesting to me than Bitcoin: Ethereum. If Bitcoin is like digital gold, Ethereum is more like a digital programmable gold computer, and it’s already created an entire ecosystem of brand new technologies around it.

P.S. Crypto is one of my newest passions, but my overarching focus in life is personal growth and intentional living. Do you want help with challenges like confidence, decision-making, or idea overwhelm? I’m a transformation coach who helps analytical thinkers get unstuck, find consistent motivation to take action, and design their life purpose. Read more about me here or my coaching practice here.