Welcome to my free cryptocurrency educational series. Each part builds on the previous ones, so I suggest starting at the beginning and moving through part by part:

Cryptocurrency 101 series (core principles, social justice, blockchain tech, Bitcoin):

- Part 0 Overview of my series, who this is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t.

- Part 1 Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

- Part 2 How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world)

- Part 3 How the blockchain keeps running, where new Bitcoins come from (i.e., how mining works), and concerns about Bitcoin’s environmental impact

- Part 4 How crypto offers autonomy, why it can’t be stopped, and the value of decentralization

- Part 5 How to store and use cryptocurrency, some basic cryptography, how wallets work, identity management, and the future of democracy

- Part 6 Overview of the different types of wallets, which one is best for you, what to be careful of, and why a hardware wallet might be worth the investment

Cryptocurrency 201 series (intermediate principles, Ethereum, NFT’s, DAO’s):

- Part 7 Ethereum (the #2 most popular cryptocurrency, and the one I’m most excited about), smart contracts, dapps, gas (and the high gas fee problem), Proof of Stake (PoS), and Ethereum 2.0

- Part 8 Coins vs. tokens, and some real Ethereum use cases—oracles and DEX’s

- Part 9 Intro to NFT’s (collectibles, research funding & historical significance, and music)

- Part 10 More categories of NFT’s (art, video games, virtual reality)

- Part 11 Wrapping up NFT’s (what you can actually do with them, upsides, downsides, risks)

- Part 12 DAO’s (organizations managed by algorithms, governance tokens, collective ownership, and the “network state”)

Cryptocurrency 301 series (advanced principles, DeFi, reinventing the finance world):

- Part 13 DeFi & CeFi, reinventing banking with peer-to-peer finance, stablecoins, and borrowing & lending

- Part 14 More DeFi (how Uniswap works, plus insurance, payments, derivatives, blockchains, exchanges, liquidity staking, and impermanent loss)

- Part 15 Wrapping up DeFi (why liquidity is important, LP tokens, yield farming, calculating return, yield aggregators, and major risks)

Cryptocurrency 401 series (investing, making money in crypto):

- Part 16 Intro to investing (what could go wrong, where you might fit in, and what kind of investing could be right for you)

- Part 17 Preparing to invest (how much money to put in, how to split it up to mitigate risk, setting up your wallets, buying the coins & tokens you want, and dealing with different blockchains)

- Part 18 More preparing to invest (security, understanding what price targets are realistic, and using “expected return” to choose between opportunities)

- Part 19 Specific investing options (buying and holding, index tokens, leveraged tokens, my list of coins and tokens, mining & staking, and lending)

- Part 20 Higher-risk, higher-reward opportunities (liquidity staking & yield farming, NFT’s, OlympusDAO, and Tomb Finance)

- Part 21 The single investment that’s made me the most money: StrongBlock

- Part 22 Wrapping up my seven categories of investment (including an update on StrongBlock)

- Part 23 How to invest depending on how much money you have (plus, the market dip, where my money is, and how to fit crypto into a larger investing strategy)

- Part 24 Holding coins & tokens vs. yield farming, where I’m putting my money now, big news on StrongBlock, and the future potential of crypto

- Part 25 Staying safe, preparing your taxes, avoiding scams, upgrading your security, and judging new projects

- Part 26 How to decide who to trust in the crypto world, technical analysis & market cycles, and an update on my longish-term portfolio

Part 26 Reading Time: 32 min

Want to listen to this post instead?

Part 1:

Part 2:

4/30 Update: I added a bit more to the section on market cycles and made some adjustments to my asset allocation.

5/9 Update: Small update about the market drop in the section about what I’m doing with my money.

5/12 Update: Another update on the market crash.

10/26 Update: Added a new section just below about what’s been happening with me since my last update.

(Disclaimer: I’m not an investment advisor, financial expert, or crypto expert, and I don’t know your individual situation. I’ll share what’s worked for me, but please figure out what makes sense for you.)

This is part 26 in my cryptocurrency educational series.

Today I’m going to give my perspective on a topic that’s hugely important when dealing with crypto: How can you know who to trust and where to get advice? Then, I’ll give you an update on my personal asset allocation.

Updates: Some reflections on the market crash and more

10/26 Update:

It’s been five months since you’ve heard from me, so I feel like I owe you all an update. I’ll deliver it in three parts.

#1: I want to give you a reminder about all the previous posts in this series:

Remember how quickly the crypto world changes.

Something I wrote back in May (or earlier) might still be relevant in many ways, but parts of it might also be totally out of date.

So, please be very careful and do your own research before blindly buying something or using some strategy just because I mentioned it months ago.

In particular, StrongBlock is completely dead to me. I strongly suggest you stay far away. It’s been my single biggest disappointment in crypto. I always knew it was risky, but I trusted the team. I imagined that if it did fall apart, it would be due to demand for nodes going down, tokenomics, or something somewhat outside the team’s control.

Turns out, that was misguided. I in large part blame them for terrible communication, making false promises, and generally handling the project and its community very poorly.

What can you learn from that?

- Always remember not to put too many eggs in one basket. I didn’t personally make the mistake of putting too high a percentage of my crypto allocation into StrongBlock (because I knew it was risky). But the mistake I did make was with the amazing gains I was getting from StrongBlock for several months. Which brings us to…

- Make your gains real by converting to cash. My mistake was funneling the majority of my StrongBlock earnings back into various crypto investments. Theoretically, I was making a huge amount of money for a while, but I lost quite a bit of it when the crypto market tanked. Sure, it’ll come back up again eventually, but I should have converted at least half of my gains into actual US dollars as I went.

- Trust your gut. You can see in all my past posts about StrongBlock that I was calling out a lot of confusing issues I saw with the project, but I still stuck with it, far beyond when I should have gotten out completely.

#2: Here’s what happened to me and crypto.

In short, two things:

First, I lost a substantial amount of money—

With StrongBlock and the general market dip, but most of all with Terra/LUNA/UST and Anchor Protocol.

It seems foolish in retrospect (as it almost always does), but I felt so convinced that the Terra ecosystem was safe, super promising, and trusted by so many people I followed.

It seemed like everyone I respected was storing large amounts of cash in Anchor Protocol. But, it was of course too good to be true to expect a nearly 20% APY to be safe.

So, the lesson is that it doesn’t matter even if lots of smart people are doing something—trust your gut, and notice when something feels too good to be true.

Also, notice if you’re putting too much money into something you don’t fully understand. In this case, I knew the basics of how LUNA/UST and Anchor worked, but I certainly couldn’t explain in detail how an algorithmically-derived stablecoin sustained its value.

So, after all this, I needed a long break. I needed to practice self-care and process my emotions. I suggest you do the same when you lose money.

Second, I’m an ENTP in Myers-Briggs, which means I have a wide variety of interests.

I love learning, and my life is a series of one passion after another.

I’d been focusing on crypto for a long time by my standards, so I was starting to lose interest, especially given how many new projects were constantly popping up. It began to feel like a never-ending game of whac-a-mole.

I began to spend more and more time on my other interests, and I noticed that the energy required to write another crypto post kept rising.

It took me several months, but now I at least have enough energy to write this update. I’m not sure if and when I might dive-deep into crypto again, but not quite yet.

If you’ve enjoyed how I’ve written about crypto though, I invite you to follow my writing on other subjects. I write for future-oriented overthinkers (‘N’ types in Myers-Briggs) about mindful personal growth, habits, mindset, & more.

In short, how to live an awesome life in the modern world—a life full of impact, belonging, and curiosity.

You can follow me on Twitter, LinkedIn, or Medium. And, you can subscribe to my mailing list below, where I send out my most popular posts and share about my coaching practice and workshops I’m offering:

#3: Here’s the portfolio I recommend to friends nowadays.

Major caveat: I’ve been out of the crypto game for about five months now. So, this definitely doesn’t represent the best of the best when it comes to cutting edge strategies.

But, it does represent what I think is a reasonable portfolio for someone like me who’s interested in crypto but doesn’t want to have to constantly read about it and follow the day-to-day market changes.

This is meant to be a long-term portfolio (i.e., hopefully no major adjustments necessary for many months or possibly a couple of years at a time).

As usual, all the caveats apply—that I don’t know you, I don’t know your financial situation, I’m certainly not an expert, and this is not financial advice.

But this is what I tell most friends nowadays who ask me what to buy in the crypto world:

| Symbol | Category | Allocation | Notes |

| BTC | Primary Blockchains | 55% | |

| ETH | Primary Blockchains | 24% |

(Split across, say, 9% raw ETH in Ledger, 7% icETH in Index Coop, 5% Lido, 3% Curve stETH)

|

| Freeway | Quant trading with crypto as collateral | 5% |

(Split across, say, 2.25% EURO Supercharger, 2.25% USD Supercharger, and 0.5% FWT token)

|

| XRP | Crypto in legal battle with SEC (i.e., a gamble) | 2% | |

| AVAX | Secondary Blockchains | 2% | |

| FTM | Secondary Blockchains | 2% | |

| ATOM | Secondary Blockchains | 2% | |

| MVI | Eth-based Index Fund | 2% | |

| DPI | Eth-based Index Fund | 2% | |

| DATA | Eth-based Index Fund | 2% | |

| GMI | Eth-based Index Fund | 1% | |

| JPG | Eth-based Index Fund | 1% |

(More info on Freeway later in this post. If you get into it, I’d welcome you to use my affiliate link if you find all this valuable. Also, I would have included a small position in Yieldnodes as well, but they just recently began changing their business model, and I haven’t researched that enough to know whether or not to keep recommending it.)

To be clear, I still very much believe in crypto—I’m just taking a break from keeping up with the crypto world as actively as I had been. It’s a lot of work!

I might do another post to wrap up this series with some notes I’ve had lying around, but that’s it for today. Thanks for reading 🙂

5/9 Update:

All the financial markets are challenging right now, whether crypto or stocks. The world economy is in a tricky spot and I won’t claim to understand everything going on. My feelings about crypto haven’t changed at all though. I’m still in it for the long-term and, as I’ve described in previous posts, I’m still using dollar-cost averaging to buy more crypto at steady intervals.

We might very well be in for a prolonged bear market that’s going to keep getting worse before it gets better (take this with a big grain of salt, but here’s one analysis that predicts Bitcoin won’t finish declining to its next low until the end of this year). So what can you do? If you still believe in crypto, hold on, and keep steadily buying more according to your asset allocation. Don’t try to predict when the bottom will hit. Just buy small amounts on a set schedule.

5/12 & 5/13 Update:

Well, it’s gotten worse since my last mini-update. In most ways, dips like this are expected and part of investing in crypto. If you just hold, you’ll usually recover.

The one part here that caught me by surprise though was the Terra/LUNA/UST crash. This ended up being the biggest disaster in the history of crypto. And sadly, Terra is most likely dead forever. (That said, I still very much believe in crypto in general.)

So what happened? Here’s my understanding: UST was an algorithmic stablecoin that was supposed to retain a nearly 1:1 ratio with the US dollar. Something happened that caused it to lose that ratio (the peg), and that triggered a cascading collapse of the Terra ecosystem.

According to one theory, LUNA experienced a coordinated attack where an unknown entity accumulated $1B of UST, borrowed Bitcoin, and intentionally created a panic which caused a bank run (where everyone pulls their money out since they no longer trust the institution). It’s possible that the perpetrator was affiliated with traditional financial institutions trying to push the price of crypto down so that their investors could short it or buy in at lower prices; but, that’s just speculation.

As I’ve processed my feelings around all this, I’d like to share some of my initial lessons and reminders from the last week:

- Regularly check on your overall crypto portfolio to ensure your asset allocation is still right (i.e., that it still matches whatever percentages you’ve decided for all your strategies, coins, and tokens). Here are two ways that it might have drifted from that:

- First: It’s gotten too complicated and hard to keep track of, so it’s not clear to you what your percentages even are anymore.

- Lesson: Don’t have too many strategies, coins, and tokens going at once. Keep it to a limited number that you can keep track of.

- Second: You had to unstake or transfer a certain coin or token that had a cool-off or waiting period, and then you forgot to do something with it. This happened to me with unstaking my LUNA on Terra Station a few weeks ago. It had just been sitting there waiting for me to do something with it.

- Lesson: Set a calendar reminder for yourself when your coin or token will be available, and make sure you follow that.

- Lesson: Even if you don’t execute a new strategy with that coin or token right away, at least convert it to a stablecoin in the meantime. Don’t just use ETH as that “holding” place either. ETH is volatile, not stable.

- First: It’s gotten too complicated and hard to keep track of, so it’s not clear to you what your percentages even are anymore.

- Make sure your overall financial asset allocation is right too.

- Lesson: Definitely don’t have more than 50% of your net worth in crypto. I had convinced myself it was ok to go a bit above that because my crypto allocation included some stablecoin strategies.

- Lesson: Remember that all stablecoins and stablecoin strategies are still crypto. They won’t remain stable for sure. Even USDC isn’t infallible.

- Lesson: Be careful of your sources of information (and remember that crypto is risky).

- I had other good reasons for trusting Anchor Protocol too. But, if I’m being honest, a big part of the reason I felt so confident holding my money there was that it was mentioned extremely often on r/cryptocurrency and other big subreddits. Those are not reliable sources of information.

- I’ve written a lot in this series about the importance of diversification. But the thing that caught me by surprise (and shouldn’t have) was how quickly the entire Terra ecosystem collapsed. I knew not to put too much of my savings into Anchor Protocol despite how appealing it looked. Luckily, I followed my own advice there and didn’t have an overly-high percentage of my money in there.

- I knew too that the 19.5% APY wasn’t sustainable. But again, I listened too much to what people on Reddit and Twitter were saying—that worst case, the APY will just drop to 15% or so. 15% is still way better than you can safely get on stablecoins elsewhere, so I didn’t worry too much. Until it dropped to 0. The truth is: Even a 15% APY is amazing, so there’s no way that kind of return could be “low-risk.” It’s too good to be true.

- Psychology is more important than strategy.

- Lesson: Make sure you’re taking care of yourself with good sleep/nutrition/exercise, a support network of human connections, and a lot of time away from crypto and technology. Turn off crypto alerts on your phone. Stop checking charts all the time.

- Lesson: For each strategy that you execute or coin/token you buy, write down your short thesis. Why are you buying it and when will you sell it. If you don’t understand the strategy and can’t articulate it, don’t do it.

If you’ve lost a lot lately, I empathize. Please try to spend time away from crypto. If you sell right now, you lock in your losses. Just try to leave your portfolio as it is and take time away to recharge before you dive back in to make sure your allocation is where you want it to be.

As a coach and counselor, I’ll tell you this: The best way to deal with challenging emotions is to accept them and be with them (ideally with someone supporting you like a therapist or loved one). Let yourself feel grief, anger, or whatever else, and don’t try to ignore it. Feel it in your body and focus your attention on that physical sensation. Breathe, and give yourself empathy. You’re trying your best.

Who can you trust in the crypto world?

There’s so much misinformation out there about crypto and investing.

Worse, a lot of people are paid to shill crappy coins and tokens. On April 18 2022, Twitter user @zachxbt exposed what is allegedly a list of prices that various “influencers” charge to talk about cryptocurrencies, many of which turn out to be pump-and-dump schemes or other scams.

We’re talking up to tens of thousands of US dollars for a shill tweet.

In fact, I just received a cold email today from the founder of a new crypto platform asking, “How much would a podcast appearance/interview session cost?” (Needless to say, I immediately deleted it, as I do for all such emails.)

So what can you do with all this confusing information out there? I’ve given advice about staying safe and secure in Part 6, Part 18, and Part 25. But now I’m going to go into the topic of influencers specifically. Here’s what I’ve learned along my own journey through crypto investing, with plenty of mistakes along the way.

I’m going to roughly define five categories of writers / podcasters / YouTubers:

- Scammers who are trying to con you in some way and steal your money—for example by convincing you that they’re on the tech support team for a wallet or exchange.

- Shillers / Pumpers who are trying to hype up a coin or token that they already own so that they’ll make a profit and then sell it and let the project die.

- “Gurus” who aren’t necessarily hyping a specific coin or token, but who make their money by selling you their subscription newsletter, their courses, their conferences, or whatever else. They’ll say things like, “My top 5 picks are about to explode. Sign up now or you’ll regret it.”

- Educators / Explorers who are trying to better understand and explain how all of this works. They do a lot of research, seek to examine claims being made and validate them, interview experts, and explain complex topics in an understandable way to spread the word about crypto. I consider myself to be in this group.

- Yield Farmers / Expert Traders, who are similar to the previous group but much more focused specifically on maximizing profits, which typically means developing complex strategies, timing the market, following trends, and generally taking on more risk for (hopefully) more reward. I have one foot in this group too (though less so lately as I’ll explain later with my asset allocation update).

So, who should you trust? If you’re considering listening to an influencer, figure out which of those groups they’re in.

It goes without saying that you should stay away from the first two groups: scammers and shillers/pumpers.

We’ll get back to “gurus” in a minute.

As for Group 4 (Educators / Explorers) versus Group 5 (Yield Farmers / Expert Traders), it just comes down to personal preference, as well as how much free time you have available to devote to all this, how interested you are in going deep into crypto trading, and how much risk you feel comfortable taking on (more on that later).

If you’re drawn to Group 5 (Yield Farmers / Expert Traders) though, you better make sure that you’re following someone trustworthy, that your security is tight, and that you carefully log everything in spreadsheets to track your true ROI (return on investment) along the way.

If you don’t keep careful track of all your trades, it’s easy to convince yourself that you’re making more money than you are.

Personally, the people that I trust most in the crypto space tend to be in Group 4 (Educators / Explorers). You can easily tell that they’re in that group because Group 4 people ask a lot of questions rather than making a lot of statements. When you listen to their podcast or watch their YouTube channel, you’ll hear them being very curious, and trying to deeply understand how everything works. They don’t sound completely sure of themselves like Groups 1 and 2.

People in the other groups, even Group 5, tend to have more answers than questions. They act as if all you have to do is follow their brilliant strategy and you can be successful too.

Certainly, some of those people are right some of the time. Until they’re not.

That’s where it’s important to keep track of how much risk you’re taking on with each trade. It’s ok to take on more risk sometimes as long as it’s only with a small amount of your portfolio.

That’s why I’m a big fan of both diversifying my assets and only putting a small percentage of my money into risky strategies.

Ok, what’s wrong with “gurus”?

The third group, “gurus,” is trickier, especially when they speak or write with eloquence and intelligence. They might even claim to have lists of all their past picks so you can clearly see that their returns have been amazing.

If so, you’d be a fool to not trust them this time too, right?

Here are three ways they get you:

First, they prey on your lack of experience.

Beyond pump-and-dump schemes, here’s another common tactic I’ve seen:

Some “gurus” will recommend a cryptocurrency that anyone who follows the space closely would feel is an obvious bet; but, if you’re more of a beginner or outsider, you won’t realize that. Then, when that coin or token goes up—as it obviously would to anyone who’s more knowledgeable—this person looks like they have special knowledge.

For example, a year ago, a friend pointed me to a so-called guru, Teeka Tiwari. My friend respected Teeka a lot and was considering signing up for the guy’s paid newsletter.

Take a moment to visit his website. To the average person, it looks legit, right? It says he’s been seen on Fox Business, CNBC, ABC, etc. In fact, it says he’s “the #1 most trusted expert in cryptocurrency” and that he’s a former hedge fund manager and Wall Street Executive.

I was willing to give the guy a chance, and I watched his big pitch video, which was excruciating since it was literally an hour of him repeating himself and telling viewers how great it feels to have financial freedom (“think about what this kind of wealth could do for your family,” “don’t you deserve that nice new car,” etc.). He barely even talked about the crypto that all of this would hinge on.

And here’s the kicker: This whole webinar was leading up to the big reveal at the end where he would announce his #1 cryptocurrency pick. As the minutes ticked by, I became increasingly curious about what this amazing pick would be. Surely it would be a less well-known coin that he somehow had insider knowledge about.

But see if you can guess what his big pick was.

That’s right: It was Ethereum.

That’s it—pretty much the most obvious possible pick in all of cryptocurrency.

But to my friend who was less familiar with crypto (he’d probably only really heard about Bitcoin), this seemed like an important piece of information. To me, it was ridiculous—obviously Ethereum was the major coin to invest in.

I know this seems laughable. You’d see right through such a scam, right? But think about how this could play out across different crypto communities.

For example, you might know a lot about Ethereum but not much about Avalanche. So, if you encountered a “guru” who specialized in that blockchain, they might seem brilliant to you by naming some Avalanche token even if that pick would be super obvious to anyone within the Avalanche community.

The second way they get you is by using classic charlatan tricks.

For example, they’ll only highlight their past wins and hide their past losses.

Unless they’ve set up some kind of automated system to publicly log every single trade they make, you have no idea if they only talk about successful ones and hide all the ones that lost them a lot of money.

They might also focus only on how great the future will be.

Even as their picks go down, they’ll just explain that this is temporary and all you have to do is hang on, keep subscribing to their newsletter, and eventually things will turn around.

The third thing that plays in their favor is that everyone looks good in a bull market.

Yes, of course they’re doing well if crypto is experiencing a bull market (i.e., a time when pretty much everything is going up).

It doesn’t take a genius to pick winners when everything is doing well. That’s what a bull market is.

But if you don’t realize that, they’ll seem amazing. And this can apply to yourself too: If you first get into investing during a bull market (for example, most of 2021), you might feel like you’re some kind of investing prodigy. Then, you might invest more than you should, until the bear market hits and you realize that you didn’t actually have any special talent for picking winners.

Beyond just “gurus” trying to sell you their newsletters though, crypto advice from anyone can still be tricky.

Even if someone you respect gives you investing advice, be careful.

I’m not proud of it, but I’m guilty of seeing a Tweet or Reddit post from someone who seems intelligent and then immediately copying their strategy without really understanding it.

Luckily, I haven’t been too terribly burned by that in crypto (though some of the strategies I copied around the OlympusDAO clones didn’t work out too well for me).

I was, however, burned much more badly back when I day-traded stocks a decade ago.

I lost a lot of money copying the trades of people who seemed brilliant. If you join a small community of stock or crypto traders who talk a big game, it’s easy to fall under their spell. To become convinced that they’re seeing something that most people are missing.

Here’s how to avoid that:

If you’re tempted to blindly follow someone’s investing advice (even mine), here’s a checklist of questions to ask yourself and things to remember.

First, can you already think of people who you consider so smart that you’d copy any investment they made? This could be people you personally know or people you follow on social media.

Notice if you’re already creating an exception in your mind: “Sure, I know I shouldn’t just blindly follow other people, but this person really knows their stuff.”

I want you to consider the following list even for those people. And if nobody comes to mind, I hope you’ll remember all this for the future.

- If they claim to have special, insider knowledge about a project, be very skeptical. They’re either a paid shill, or they’re lying, or it’s some kind of Ponzi scheme.

- Here’s the only type of exception that comes to mind for me: A small number of times, I’ve heard of crypto influencers signing NDA’s and then being allowed to see more information about a project’s financial records or upcoming features. Afterward, they might share with their followers that what they saw seemed impressive but they’re not allowed to share specifics yet. Again though, this is not common. In all the time I’ve been investing in crypto, I can think of only two times I’ve heard about this happening with people I respect.

- Be skeptical too if someone is still acting like crypto is a secret club that only they and their followers understand.

- This isn’t the early days of crypto anymore. Virtually every major bank and financial organization now has a team of experts devoted to this world. Similarly, if you’re a Redditor, you probably imagine sometimes that Reddit is a website that most people don’t know about. The truth is that it has 430 million active users.

- Even if someone tells you to buy a certain coin or token, are they going to stick around to tell you exactly when to sell as well? Or are you on your own?

- If a friend asked you to explain every investment you hold, would you be able to, or could you just say so-and-so bought it so I did too? Does that feel safe?

- If someone is only now posting about their purchase on Twitter or Reddit, who knows when they actually bought it. Even if it was only a few minutes before, the market changes very quickly and conditions might no longer be right to get in.

- Do you understand the full strategy of the person you want to copy? What if one thing they just bought is actually dependent on something else they already own from a month ago? Do you know what to look out for to know when the strategy needs to be adjusted?

- Is your risk level and overall financial situation the same as the person you want to copy? If they have multiple times the net worth that you do, your risk levels should be wildly different. Maybe throwing around $10,000 is low-risk to them but it represents months of your salary.

What about “technical analysis” and “market cycles”? Smart people seem to talk about those.

This is one of the trickiest ways you can get hurt, especially if you’re a smart analytical thinker who looks for signals of intelligence.

Imagine this: You read an article from some “guru” explaining their strong gut feeling that a certain token is about to shoot up to the moon. You’re skeptical, right?

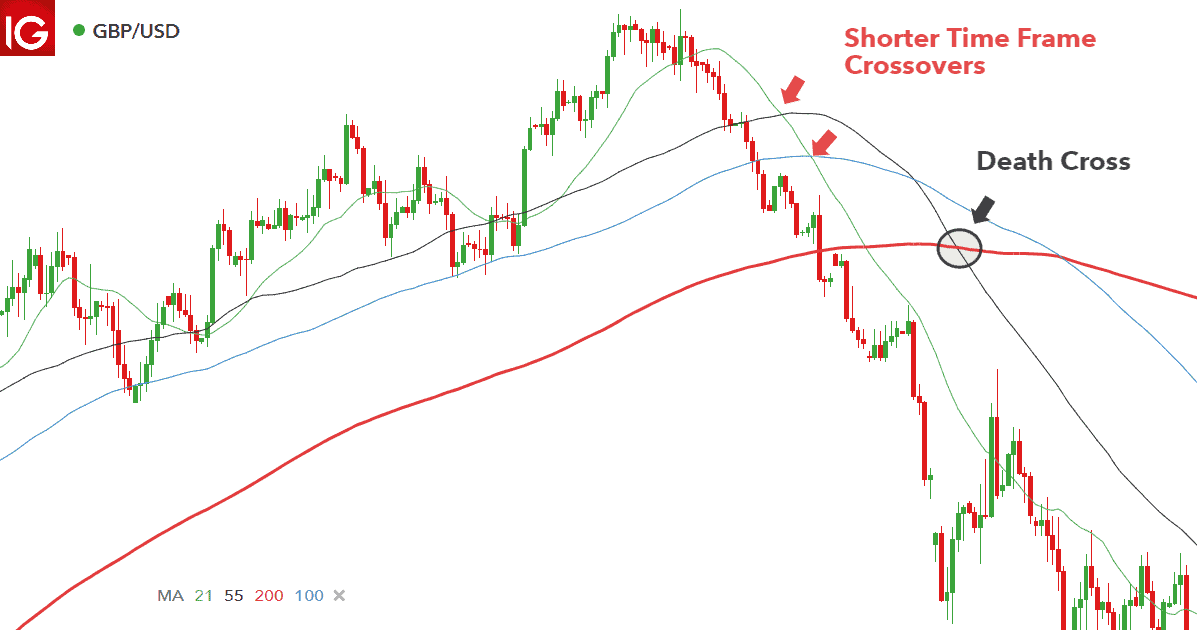

Now imagine this: You read a different article, but this one is written in more academic-sounding language and includes fancy-looking charts marked up with mathematical-looking lines? What if this person is not a “guru” but a “financial analyst,” and they confidently explain that there are multiple signals all pointing to a “clear example of a Death Cross pattern”:

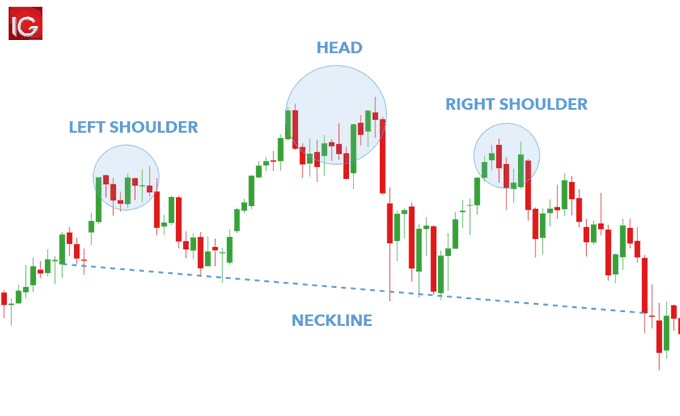

Maybe it’s a “Head and Shoulders” pattern? Again, everything looks very official and academic:

Indeed, you can Google those pattern names and you’ll find all sorts of websites acting as if these are highly scientific, rigorously-researched phenomena.

That’s what so-called “technical analysis” is in the investing world (not just crypto, but originating in stock trading).

It’s so easy to get swept up in all this that I myself ended up studying TA for years when I was younger and day-trading stocks.

The problem is: Despite how often people talk about TA in the investing world, there’s very little research proving that this stuff actually works.

To be fair though, because belief in technical analysis is so widespread, it sometimes makes the patterns real. If a lot of traders out there believe that we’re in a Head and Shoulders pattern on a certain stock or cryptocurrency, they might end up buying or selling based on what that pattern says should happen next, and thus it becomes a self-fulfilling prophecy.

But please know that these things are by no means as scientific and precise as they look.

To be fair, there are a small number of experts who have either consistently gotten lucky or who truly do have an abnormally high level of skill in this area. However, the people consistently earning money through TA are probably either employed at top hedge funds or keeping their secrets to themselves.

Either way, they’re probably not the people tweeting out the patterns they’re seeing.

I know it’s easy to imagine that I’m just missing something here. You’ve probably seen technical analysis referenced all over the place by smart-seeming people.

And yes, some of the crypto influencers I respect most do point out technical analysis patterns sometimes (particularly support/resistance levels), so I’m not claiming that it’s completely useless. But what I’ve seen from those people is that they don’t just rely on a single pattern or signal—they wait until multiple different ones are showing up at the same time for confirmation before they act on them.

I imagine they would say that what technical analysis reveals is just one data point of many that they use in their decision-making.

Even so, I urge caution here. I’ve yet to see any real proof that most of the techniques from the technical analysis world consistently deliver reliable, actionable information.

But don’t just trust me—try searching yourself for reputable scientific studies proving that technical analysis is valid and can consistently produce results better than chance.

Similarly, you’ll hear people talking about “market cycles” and trends as if they’re both obvious and inevitable.

These aren’t just random YouTubers, either—you’ll hear this stuff discussed at length on MSNBC and Bloomberg too.

They’ll show impressive-looking charts with trendlines, and they’ll talk about how we’re about to enter a deflationary cycle, or about how Bitcoin is testing new highs and is about to take off to push through its 200-day moving average.

You need to keep reminding yourself: If they were consistently right, they’d all be rich. Their charts look fancy, but the truth is that these people don’t know for sure.

Over the past 15 years, 92% of large-cap mutual funds actively managed by a fund manager did worse than the S&P500 index. In other words, all those managers charged their customers a fee to manage their money in some supposedly special way, but those customers would have been better off simply buying a low-fee ETF designed to match the S&P500.

In terms of market cycles, I won’t deny that it’s valuable to know whether we’re likely in a bear or bull market. Different investment strategies will work better in each one. The trick though is figuring out when we’re about to enter or exit either one of those, and that’s where I see people becoming overconfident in the predictive power of various indicators.

I can’t reiterate enough that the confidence with which someone speaks is not correlated with their accuracy.

Everyone on MSNBC (or whichever business channel) looks so professional in their expensive suits, speaking so fluidly about market cycles and patterns; but, that doesn’t make them any better at predicting where the stock market is headed—or the crypto market.

Be careful too if you find yourself thinking something like this: “Oh sure, I wouldn’t trust the people on a mainstream site like Bloomberg or Motley Fool. But, I do follow YouTuber X or Twitterer Y who really knows what they’re talking about.”

Maybe they do, maybe they don’t.

Yes, they might have accurately predicted a few cycles, but lots of people have been able to get it right a few times. And if you keep making big risky bets and one of them is wrong, you might lose an amount of money that becomes damaging.

So what’s the alternative?

To pick cryptocurrencies that you believe in, then just buy and hold until you hit your goal. Use dollar-cost averaging to buy in a little at a time on a set schedule (as I describe in Part 17). Don’t worry about what cycle or pattern we’re supposedly in, and don’t try to time the market.

Instead of looking for patterns in charts, I look for patterns in the recommendations of people I trust.

If one person I follow on Twitter mentions a hot new DeFi opportunity, I might not pay close attention. But if multiple people mention it, I start taking it more seriously.

Also, as I alluded to earlier: I think it’s worth being very careful of people who are pumping something—because they probably own it and they’re trying to make money themselves.

But, to be fair, I also see a lot of awesome people in this space who are acting as angel investors, promoting and evangelizing crypto-related topics that they truly believe in (for example, I really do believe that @DCinvestor promotes certain NFT artists not just because he owns their NFT’s, but because he really believes in them and wants to help them out).

Sure, a lot of people are just in it for the money, but I’m also seeing that a lot of crypto lovers are ideologically aligned here, wanting to make a more decentralized, open, and accessible world. So, sometimes these people will be promoting a token that, yes, they own; but, they might also really believe that it will make the world a better place in some way. Similarly, they might be supporting up-and-coming artists by buying their NFTs and then promoting them.

Overall here, I invite you to notice what kind of content you’re consuming. Is it more like someone asking a lot of questions, talking with experts, getting different opinions and perspectives, and ensuring that their listeners or viewers really understand the fundamentals of how everything works and then letting them draw their own conclusions? Or is it more like someone telling you they’ve figured out the secret to making a lot of money and offering you a complex, risky strategy to follow?

I’m not saying to stay away from the latter entirely, but just try to strike the right balance.

Who do I personally follow?

I won’t claim that any of these people are perfect or that you should trust everything they say. But, here are some people I personally follow and generally trust to have good ideas (by the way, I was never a Twitter user before; but, in my experience, that’s the best place to follow these types of people, so I’ve linked to everyone’s Twitter account).

By the way, I’ve also started tweeting a bit recently. You can find me at @mcaloz_ENTP.

The people I trust most:

- Stephen the Calculator Guy—I started following Stephen for his StrongBlock calculator, but I’ve begun trusting his opinions more and more on a range of topics. He thoroughly researches projects, explains things clearly, and gives back a lot of his profits to charity. He seems like an awesome person in general. A lot of his strategies are on the advanced side though in terms of difficulty to execute.

- Kevin Rose (and his Modern Finance and Proof podcasts)—I have a huge amount of trust in Kevin, especially around NFT’s. He’s someone who I feel does his homework, stays open-minded, and asks a lot of good questions. I would also call him fairly conservative and risk-averse with investing.

- Bankless (newsletter and podcast)—If you’re going to follow only one source in crypto, this should probably be it. They skillfully cover a wide range of topics.

- Balaji Srinivasan—Balaji is a divisive figure. He’s clearly brilliant, but sometimes it feels like he’s focusing so much on abstract philosophical concepts that can be hard to fully understand or connect to reality. It could also be that he’s simply operating on a different timescale than the rest of us and looking more at the next 10-20 years. He’s outspoken about his political and sociological beliefs too, and I don’t always agree with him there.

- The DeFi Edge—I’ve only been following him more recently, but he writes very solid, well-researched threads on a variety of topics related to crypto, asset allocation, and investing psychology.

- DCinvestor—One of the very best people to follow about NFT’s especially, but he tweets a lot.

- Taiki Maeda—He’s a former professional poker player who’s become an expert in yield farming in particular. I’ll admit that I haven’t actually followed many of his strategies since they can get complex and require a lot of effort. But, every video of his that I’ve watched has felt legitimate and helpful. To me, this is the guy to follow if you’re wanting to make great returns in crypto and are willing to regularly put in a good number of hours to make that happen.

- Green Pill—This is my go-to guy for high-risk-high-reward projects. But be careful: Some of his picks involve a huge amount of risk.

Other crypto people I’ve heard helpful things from but haven’t researched as much:

- Showtime2kX

- Van Life Income

- 6529

- Josh Rosenthal

- Raoul Pal

- Ari Paul

- Baconesq

- Reddit /r/CryptoCurrency—Be very careful here and on other crypto subreddits: There are some useful opinions, and a lot of immature ones too. You can often have better luck by checking out the subreddit for a specific blockchain or project, but recognize that people there are of course going to be biased and will likely present things in the most positive possible light.

- You can see the full list of people I follow on Twitter here.

Overall, please be careful out there. So many crypto “influencers” accept payment to mention scammy tokens on their channels. I personally receive at least one message every few weeks asking me about my “prices” for promotion. They’re not even asking if I’m willing to promote them—they act as if it’s a given that if I have a crypto podcast I must have a price (whether it’s just to recommend their token or to invite their representative onto my podcast for an interview).

(Naturally, I’ve declined every offer that I’ve ever received to be paid to talk about crypto.)

Ok, let’s move on to the update on my asset allocation.

What am I doing with my money right now?

To be honest, I’ve been getting tired of having to put so much work into crypto investing. I’ve largely enjoyed it, but I’ve been realizing more and more that putting many hours of work into this stuff every day becomes more like a job than a hobby.

So, I’ve been consolidating and simplifying things, selling some of the investments I no longer believe in, and preparing my portfolio to be a lot more passive. My goal right now is to have something that I only need to check in on once in a while.

Specifically, my plan is to use a regular schedule that coincides with the day my StrongBlock earnings hit a certain number. Then, I’ll cash out and distribute that income to whichever parts of my portfolio have fallen below their proper allocation (which I’ll describe in a minute).

As a reminder, I went into more detail in Part 23 on how I might allocate money depending on how much money you have. Again, I’m not advising you to invest this way. I’m just sharing what I’m personally doing since I’ve found it beneficial in the past to see what other people I respect in the crypto space are doing with their money.

(But remember what I said earlier about one of the dangers of blindly copying influencers: Even if you buy exactly what I own right now, you won’t know when I make adjustments or sell positions. So, before entering into any of this yourself, please make sure you understand it at least well enough to know if it’s time to get out.)

Here’s what my personal crypto portfolio looks like today.

As always, this very much depends on your life situation: your age, your risk tolerance, your income and savings, and so much more.

But here’s what I would recommend to someone roughly like me who:

- Makes good income and has comfortable savings;

- Doesn’t have dependents;

- Doesn’t want to have to be doing a lot of active investment management;

- Doesn’t need the money immediately and won’t be in huge trouble if it dips in value quite a bit over the next couple of years.

Again, I am definitely not an investment advisor or professional wealth manager. When you see me listing specific percentages, it becomes easy to imagine that all this is more precise and mathematically-derived than it actually is. A lot of this is just what “feels right” as I’ve been sitting with it for a while.

First, here’s how I would allocate my money at a high level:

- 45% in crypto, including a mix of lower-risk stablecoin investments, medium-risk L1’s, and higher-risk strategies (more detail below)

- 40% in Wealthfront, a robo investor of traditional stocks, bonds, etc. (or, if you’re managing ETF’s on your own, it seems to me like over-weighting toward foreign ETF’s rather than US-driven ones might make sense because of that pessimism I just mentioned)

- 6% in a cash emergency fund, i.e., a checking/savings account at a traditional bank (the 6% number is rough, and I think a more appropriate number would be 6 months’ worth of your core living expenses)

- 5% in Fundrise or some other way of investing in real estate

- 4% more in cash, gold, or something else that’s stable and easily accessible in case the stock and crypto markets drop even more dramatically (i.e., this is to be able to buy if everything has dipped to a much lower level, which would be difficult to time in any case; but, I sometimes find myself pessimistic lately about politics, and it feels important to have cash in reserve)

Next, I’ll present two versions of the crypto-specific allocation: the more complex version that I’m personally using and a simpler version that will likely work better for most people.

For both of these, if you’re putting less than, say, $25K USD into crypto overall, I would drop some of the lowest-percent items since it probably won’t do you much good to have only a couple hundred dollars in something.

As you look through this, remember: In general, the higher the APY, the higher the risk; and, most of these APY’s will probably be different by the time you read this.

Also, here’s a spreadsheet version that you can copy to use yourself.

My crypto allocation—the complete version:

Risk level 1 (stables & “safe” opportunities: 8% of total):

- 5.0% UST in Anchor Protocol (19.5% APY)

- From what I’ve seen, Anchor is widely regarded in the DeFi community as having the best return for relatively low risk. If you like, you can mitigate your risk further by buying insurance through both Nexus Mutual and Unslashed (to cover two different kinds of risks). Also, the APY of Anchor will likely be dropping in the next month or two, but probably not drastically.

- 1.5% USDC in Celsius (7.1% APY)

- 1.5% DEI/USDC in Beefy’s “One God Between Two Stables” pool on Fantom (38% APY)

Risk level 2 (core holdings: 44% of total):

- ETH (22% total):

- 6.5% earning in Celsius (5.4% APY)

- 5.0% Index Coops’s icETH token (10% APY)

- 3.5% in Ledger wallet (0% APY)

- 3.5% staking in Lido (3.9% APY)

- 3.5% in Curve’s stETH pool (2.5% APY)

- BTC (22% total):

- 10% earning in Celsius (5% APY)

- 6% in Ledger wallet (0% APY)

- 6% earning in Crypto.com (3% APY)

Risk level 3 (alternative Layer-1’s: 23.5% of total)

- 7.5% LUNA staking in Terra Station (6.5% APY)

- AVAX (5.0% total):

- 3.0% staked in Avalanche (11% APY)

- 2.0% in USDC/AVAX in Beefy’s “USDC.e-AVAX” pool on Avalanche (19% APY)

- FTM (5.0% total):

- 2.0% in USDC/FTM in Beefy’s “Fantom of the Opera” pool on Fantom (13% APY)

- 1.5% in DAI/FTM in Beefy’s “Phantom Dai Opera” pool on Fantom (15% APY)

- 1.5% in Ledger wallet

- ATOM (2.5% total):

- 1.25% in ATOM/OSMO in Osmosis’s “ATOM-OSMO” pool (52% APY)

- 1.25% staked in Keplr wallet

- 2.0% SOL staked in SolFlare (8% APY)

- 0.5% RUNE in Ledger wallet

- 0.5% MATIC staked in Polygon wallet (8% APY)

- 0.5% XTZ staked in Temple wallet (5.5% APY)

Risk level 4 (index tokens, solid platforms, etc.: 21.0% of total)

- 4.5% BTC, EURO, FWT in Freeway (40% APY)

- Specifically: 1.8% of overall total in BTC, 1.8% in EURO, and 0.9% in FWT. (ETH or USD would be equally fine too, but I chose BTC and EURO just to get more diverse exposure.)

- Freeway offers a high return on BTC, ETH, USD, or EURO at relatively low risk. My understanding is that they’re a regulated broker in the EU (working toward that status in the US too), and they use your crypto as collateral to borrow against; then, their team does hedge fund-style quant trading to make the actual return. More good info here and here.

- (If you decide to invest in Freeway, I’d appreciate it if you used my affiliate link. I know that sounds scammy, sorry, but I can promise you that I chose to put money into Freeway before I even knew they had an affiliate program.)

- 3.5% Yieldnodes (214% APY)

- Yieldnodes offers a managed server rental program for blockchain masternodes. You can deposit money in the form of BTC or USDT, but everything is pegged to the Euro rather than to the price of Bitcoin. It seems to have delivered consistent returns for well over a year. More good info here.

- (If you decide to invest in Yieldnodes, I’d appreciate it if you used my affiliate link. Again, I already put money here before I knew they had an affiliate program.)

- 3.0% MVI in Ledger wallet

- DPI (3% total):

- 2.0% in Ledger wallet

- 1.0% staked in Vesper DPI pool (5.7% APY)

- 2.0% DATA in Ledger wallet

- 2.0% UST in Aperture Finance‘s Delta-neutral-mAAPL pool (32% APY)

- This offers easy cross-chain strategies that are delta-neutral, meaning they should theoretically work well whether the market is rising or falling. More good info here.

- 1.5% RPL in Ledger wallet

- Token for the best decentralized Ethereum staking protocol.

- 0.75% GMI in Ledger wallet

- IndexCoop’s new index token for early-stage, high-growth DeFi projects.

- 0.75% JPG in Ledger wallet

- IndexCoop’s new index token for blue-chip NFT collections.

Risk level 5 (high-risk-high-reward, playing around: 3.5% of total)

- 0.5% LRC in Ledger wallet

- Token on the Ethereum blockchain for a Layer-2 DEX and payment app, meaning that it allows token swaps that are dramatically faster and cheaper than Layer-1 DEX.

- NEAR (1% total):

- NEAR is the coin for an emerging, highly-scalable blockchain.

- 0.5% in Ledger wallet

- 0.5% in Vaporwave‘s “TRI-WNEAR” pool (111% APY)

- 0.5% XRP in KuCoin

- 0.5% OlympusDAO

- 0.5% ZIL in Ledger wallet

- I don’t know a lot about this new blockchain, Zilliqa, but Green Pill likes it.

- 0.5% JEWEL in Ledger wallet

- I don’t follow the crypto gaming world much, but I’ve seen multiple people I respect recommend JEWEL from DeFi Kingdoms.

It’s worth noting here that I haven’t included StrongBlock since I see it as a sunk-cost for me at this point. I’ve put a large amount of money into it that can’t be removed (at least until nodes can be sold in the future when the marketplace is released), so I no longer have it in my spreadsheet that I use for allocating money.

But, if I didn’t yet have a position in StrongBlock, I’d likely put around 5% into it as you’ll see below.

So, that allocation above is pretty much exactly where my money is right now (I’m still in the process of re-allocating some things since exiting some of my old positions involves hold periods).

I recognize though that the above is way too complex for most people and that it also requires a significant amount of capital.

Below is what I would recommend instead for most people (and again, not a financial advisor or crypto expert, but this is what I’d tell most of my friends right now if they asked for advice).

My crypto allocation—the simplified version:

Risk level 1 (stables):

- 6% Anchor

- 4% Celsius USDC

Risk level 2 (ETH/BTC):

- 22% ETH

- 22% BTC

Risk level 3 (alternative Layer-1’s):

- 7% LUNA

- 6% AVAX

- 6% FTM

- 3% ATOM

Risk level 4 (index tokens and solid dapps, etc.)

- 5% Freeway

- 3% MVI

- 3% DPI

- 2% DATA

- 1% GMI

- 1% JPG

Risk level 5 (high-risk-high-reward, playing)

- 5% StrongBlock

- 4% Yieldnodes

Again, that’s not what I would recommend to everyone, but I hope that it’s a good starting point as you customize the asset allocation that works for you and your unique life situation.

Remember my strategy though for where to get advice: Don’t just rely on one person, and don’t just copy exactly what they’re doing without understanding it. Check out some of those other Twitter accounts I mentioned, figure out whose voice you like best, do your own learning, and combine the best bits you hear from a variety of sources.

Good luck!

—

P.S. Crypto is one of my newest passions, but my overarching focus in life is personal growth and intentional living. Do you want help with challenges like confidence, decision-making, or idea overwhelm? I’m a transformation coach who helps analytical thinkers get unstuck, find consistent motivation to take action, and design their life purpose. Read more about me here or my coaching practice here.