Welcome to my 10-part 21-part, deep-dive educational series on cryptocurrency. This post will explain who this series is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t. Then, I’ll finish by giving you an overview of where else we’re headed with this series.

Thanks for reading!

Part 0 Reading Time: 16 minutes

Want to listen to this post instead?

Who is this series for? Almost anyone!

This is aimed at everyone from the curious novice to the intermediate crypto investor. In fact, it’s even aimed at people who haven’t been terribly interested in the financial world but are interested in social justice, transforming society, and new opportunities for creativity.

Ever since I got interested in this stuff, I’ve been amazed by how many different categories of knowledge go into truly understanding the world of cryptocurrency: computer science, psychology, economics, investing, history, politics, art, and more. I love it because it’s so multidisciplinary.

But that also means that people buying crypto can be at very different places in terms of their understanding:

- On one end, you’ve got people putting huge amounts of money into Dogecoin without understanding the tech behind it or the level of risk they’re taking on.

- On the other end, you have brilliant techies who read the technical whitepapers and even participate in influencing the future of these emerging technologies.

- You have people outside the tech world who do their research and put in the time and effort to set up servers and mine their own crypto coins.

- You have artists creating NFT’s, investors using complex strategies to make money in DeFi, and everyone in between. (Don’t worry if those words don’t mean anything to you right now—I’ll explain all of this.)

Bottom line: It’s a lot to take in, and it’s not easy to get started in this world. It can also be very confusing to find the right resources for your specific knowledge level.

I want to help you.

This series is for you if:

- You’ve heard people talk about crypto, but you still don’t understand exactly what it is, why it’s useful, and if you can trust it. Does anyone actually use Bitcoin? Isn’t it just “made up”?

- You see crypto as some kind of ponzi scheme, delusional speculation, or only for techies who want to make money. Or, you’re worried about the environmental impact of crypto.

- You’ve been told you should invest in it, but you’re not sure who to trust, or it all feels too complicated.

- You’ve already bought a bit of BTC, ETH, DOGE, LTC, etc.; but, if you’re really honest with yourself, you don’t truly understand what you own or how it all works.

- You’ve been following the advice of some “crypto guru” on YouTube, email newsletters, etc., but you don’t feel confident in your own ability to decide what is and isn’t a good investment.

- You’ve jumped into this crypto stuff, but you don’t really understand investing in general—should you be all in on crypto or have some money in stocks and bonds too? Or is the traditional financial industry about to collapse?

- You own some coins and tokens, but you don’t deeply understand concepts like wallets, gas, mining, staking, proof-of-work, liquidity, yield farming, etc.

Why should you consider listening to me? I have a solid background in the tech industry.

I’m an ENTP in Myers-Briggs, and one of my greatest talents is synthesizing information—doing the research, asking the right questions, and logically determining which data and perspectives are most relevant.

I’m not a crypto expert. But, I am skilled at figuring out who the experts are and finding the common patterns in what they’re saying. In other words, I like finding complex topics to learn about, then diving in deep and reframing the information to make it easier for other people to understand.

That said, I do have some relevant background worth naming:

- I spent a decade as a management consultant specializing in the tech industry. Fortune 500 companies brought me in to solve their complex challenges, so I deeply understand how the tech industry works, and I’ve been skilled at spotting trends.

- I studied computer science at one of the top 10 universities in the United States for that subject.

- I spent years working as both a user experience designer and digital product manager, so I’m quite familiar with the world of app and website development.

- I’ve been seriously investing for over 15 years, and I spent a couple of years day trading stocks as well, so I’m well aware of both the general principles of making money as well as what financial scams look like.

But, please don’t just trust me. Do your own research and make sure you truly understand this stuff before investing.

Why do I care? I don’t want people to get hurt.

Speaking as someone who’s spent a lot of time working with top tech companies, crypto feels like a set of technologies that’s about to change the world. And in the next post, I’ll explain in detail why I think cryptocurrency is so interesting.

Part of my excitement here is simply to spread the word: “Look! This huge new thing is happening and most people don’t realize it yet!”

But there’s another important piece too: I feel a lot of care for people who are jumping into crypto without a solid understanding. The truth is that this stuff is very complicated. It took me a long time to feel comfortable, and I want to help people just getting into it so they don’t make costly mistakes. It’s painful to me when I hear about people putting their life savings into Dogecoin (or, worse—Shiba Inu).

I get it: You want to make a lot of money quickly.

And I do think there are ways of doing that in the crypto world. But if it seems too good to be true (“Just buy Dogecoin whenever Elon Musk tweets about it! He’s got our backs!”), it probably is. That kind of strategy won’t last.

If you instead use more sophisticated strategies based on knowledge instead of luck, you’ll reduce your risk while still potentially making a lot of money. But again, it’s not easy. It takes time to learn, and I want to help you do that.

Ideally, I also want to show you how crypto can be about more than just making money. In part 8, I’m going to get into all sorts of interesting applications for crypto tech beyond just investing.

Quick legal disclaimer: This is not investment advice.

This is for informational and entertainment purposes only.

I’m not a financial advisor.

I’ve spent many hundreds of hours researching crypto over the past several months. But there’s so much to learn here, and I’d say I’m still only at the “intermediate” level.

Please, please do your own research.

Don’t buy crypto until you understand it (at least well enough to protect yourself with a solid wallet, 2FA, etc.—if you don’t know what those things mean, please don’t buy crypto).

By the way, I also want to be upfront that I personally have a good amount of money invested in crypto.

Throughout this series, I’ll be mentioning various cryptocurrencies and crypto projects that I find interesting, and because of that, I have an investment in many of them (though just a small one since the vast majority of my crypto investment is in Ethereum and Bitcoin itself).

However, my goal is to be highly objective and honest here, so I’ll be calling out problems I see in the crypto world (e.g., Bitcoin’s negative environmental impact), and I’ll be writing about mistakes I’ve made and lessons I’ve learned as well.

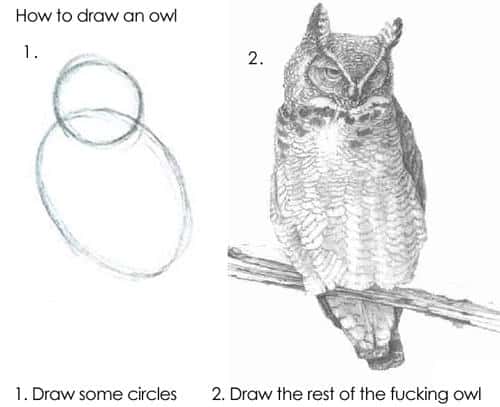

Again, this stuff is amazingly complex. It’s easy to think you get it—until you don’t.

In my experience wading into crypto over the past few months, there tend to be two types of articles:

- Articles from the mainstream media that keep everything super simple and high-level (and are often warning the reader about how dangerous or silly cryptocurrency is).

- Articles from brilliant people with deep technical expertise that offer excellent, precise information on the intricacies of crypto investment strategies but assume (what I would call) a very high level of understanding. These articles tend to use a lot of jargon, and they skip over all sorts of concepts that probably seem obvious to the author but have required me to keep a dozen other tabs open to look things up and ask questions on Reddit.

It’s been very, very hard for me to find “in-between” resources, particularly for topics like DeFi, liquidity staking, joining a mining pool, etc. My goal with this series is to bridge that gap by following a smooth gradient all the way from the most beginner-level topics to intermediate-level (and maybe even a few advanced-level) ones.

(source: Know Your Meme)

(source: Know Your Meme)

Even if you’ve already gotten started in the crypto world, I can speak from personal experience that it’s incredibly easy to fall down a slippery slope of confusion from:

- “My friend told me Bitcoin is like digital money and I should probably invest in it” to

- “Ok, this makes sense, use the Coinbase app to convert $1,000 USD to 0.018 Bitcoin, got it” to

- “Wait, what?? They’re telling me to connect my wallet to Matcha to convert my ETH into YFI, but I need to wait till gas prices are low?” to

- “Where’s the best risk-adjusted ROI for my ETH? Should I just leave it in my Ledger hardware wallet, or yield farm via Compound, or stake in Rocket Pool? What are the pros and cons of each, and how safe is all this, really?” to

- “Ok, it’s telling me to unstake my LP Tokens. Then I have to migrate from yveCRV-ETH LP into yvBOOST-ETH LP to enjoy Sushi and Pickle rewards. But I can’t forget to approve and stake my Pickle LPs. Is this even real???” (Yes, this is a real set of instructions 😆)

Don’t worry: I’m going to walk you through all this (well, we’ll see about #5 😂).

But again, I want you to please be careful.

You might hear about friends or people on Reddit making huge returns either through luck (e.g., buying DOGE before it shot up) or through more complex strategies (e.g., liquidity staking). But complex strategies can fail spectacularly too, and even solid projects can be hit hard by hacks or bugs. Here are two very recent examples that I’ve personally seen:

- On June 16 2021, Alchemix (a really cool project I’ll be talking about in a future post) announced a bug that had been discovered in their code. Even though they caught it and began developing a fix very quickly, the value of the Alchemix token (similar to a crypto coin) dropped nearly 15% that day.

- Recently (mid-June 2021), people on Reddit were talking a lot about a crazy crypto opportunity (TITAN/IRON on SushiSwap) that was earning an annual return of 1,753%, or nearly 5% a day. It was actually working for a little while, and even Mark Cuban got into it. Just two days ago, a Redditor posted, “With Iron Finance and TITAN being the clear flavor of the month due to insanely high APRs, everyone is flocking to the protocol but no one is talking about the risk of doing so.” Then, yesterday (6/16), everything fell apart and the TITAN token went from $64.04 to $0.00082 in less than 24 hours.

- A fascinating and important part of this story is that all this probably wasn’t caused by a bug, exploit, or rug pull (a scam where the coin creators trick everyone and run away with their money). According to the post-mortem, it was simply a bunch of whales (people who owned a lot of this crypto) manipulating things with some very complex strategies, and that eventually caused a bank run (where everyone loses faith and pulls their money out of a bank or investment).

I don’t say this to scare you away from crypto, because I do think there’s so much potential in this space.

But, I am trying to scare you away from putting a lot of money into anything you don’t fully understand. And even when you do understand it, I want to encourage you to manage your level of risk. I’ll walk you through that in a later post devoted to investing.

(Spoiler alert: Until you’re very familiar with crypto, please don’t invest more than 1-3% of your total wealth into it. And if you’re going to buy anything, I’d stick with just Bitcoin and Ethereum until you understand all this quite well. But again, not investment advice.)

I’ve divided this series into three four sets of posts:

- The first (the 101 set) is a complete introduction to cryptocurrency. It covers all the basic concepts you need to know, and I use Bitcoin as my example since it’s the #1 most popular cryptocurrency and the easiest one to understand. By the end of the 101 set, you’ll know enough to understand how cryptocurrency works, why it’s fundamentally different from every currency that’s come before it, and how to safely buy and hold Bitcoin.

- The second (the 201 set) dives into Ethereum—the #2 most popular cryptocurrency—as well as some more intermediate concepts. In my opinion, the Ethereum ecosystem is not only where there’s more money to be made, but also more opportunity for major innovation, creativity, and societal transformation. In this set, we’ll cover some Ethereum use cases you might have heard about (but are commonly misunderstood) like NFT’s and DAO’s.

- The third (the 301 set) brings it all together to explain some advanced concepts focusing on DeFi, or decentralized finance. This is one of the most active and exciting spaces in crypto since the goal is literally to invent the entire global finance system—everything from savings accounts, to loans, to insurance.

- The fourth (the 401 set) explores how you might be able to contribute to the crypto world and how you can best invest in this space. There’s a lot of opportunity here, but it’s also easy to lose a lot of money. So, I’m leaving this till the end once you have a solid understanding of all the key concepts that you’ll need if you want to safely and confidently invest in crypto.

Here are the four sets in detail:

Welcome to my free cryptocurrency educational series. Each part builds on the previous ones, so I suggest starting at the beginning and moving through part by part:

Cryptocurrency 101 series (core principles, social justice, blockchain tech, Bitcoin):

- Part 0 Overview of my series, who this is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t.

- Part 1 Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

- Part 2 How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world)

- Part 3 How the blockchain keeps running, where new Bitcoins come from (i.e., how mining works), and concerns about Bitcoin’s environmental impact

- Part 4 How crypto offers autonomy, why it can’t be stopped, and the value of decentralization

- Part 5 How to store and use cryptocurrency, some basic cryptography, how wallets work, identity management, and the future of democracy

- Part 6 Overview of the different types of wallets, which one is best for you, what to be careful of, and why a hardware wallet might be worth the investment

Cryptocurrency 201 series (intermediate principles, Ethereum, NFT’s, DAO’s):

- Part 7 Ethereum (the #2 most popular cryptocurrency, and the one I’m most excited about), smart contracts, dapps, gas (and the high gas fee problem), Proof of Stake (PoS), and Ethereum 2.0

- Part 8 Coins vs. tokens, and some real Ethereum use cases—oracles and DEX’s

- Part 9 Intro to NFT’s (collectibles, research funding & historical significance, and music)

- Part 10 More categories of NFT’s (art, video games, virtual reality)

- Part 11 Wrapping up NFT’s (what you can actually do with them, upsides, downsides, risks)

- Part 12 DAO’s (organizations managed by algorithms, governance tokens, collective ownership, and the “network state”)

Cryptocurrency 301 series (advanced principles, DeFi, reinventing the finance world):

- Part 13 DeFi & CeFi, reinventing banking with peer-to-peer finance, stablecoins, and borrowing & lending

- Part 14 More DeFi (how Uniswap works, plus insurance, payments, derivatives, blockchains, exchanges, liquidity staking, and impermanent loss)

- Part 15 Wrapping up DeFi (why liquidity is important, LP tokens, yield farming, calculating return, yield aggregators, and major risks)

Cryptocurrency 401 series (investing, making money in crypto):

- Part 16 Intro to investing (what could go wrong, where you might fit in, and what kind of investing could be right for you)

- Part 17 Preparing to invest (how much money to put in, how to split it up to mitigate risk, setting up your wallets, buying the coins & tokens you want, and dealing with different blockchains)

- Part 18 More preparing to invest (security, understanding what price targets are realistic, and using “expected return” to choose between opportunities)

- Part 19 Specific investing options (buying and holding, index tokens, leveraged tokens, my list of coins and tokens, mining & staking, and lending)

- Part 20 Higher-risk, higher-reward opportunities (liquidity staking & yield farming, NFT’s, OlympusDAO, and Tomb Finance)

- Part 21 The single investment that’s made me the most money: StrongBlock

- Part 22 Wrapping up my seven categories of investment (including an update on StrongBlock)

- Part 23 How to invest depending on how much money you have (plus, the market dip, where my money is, and how to fit crypto into a larger investing strategy)

- Part 24 Holding coins & tokens vs. yield farming, where I’m putting my money now, big news on StrongBlock, and the future potential of crypto

- Part 25 Staying safe, preparing your taxes, avoiding scams, upgrading your security, and judging new projects

- Part 26 How to decide who to trust in the crypto world, technical analysis & market cycles, and an update on my longish-term portfolio

Ready to learn more about why crypto is exciting? Part 1: Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

P.S. Crypto is one of my newest passions, but my overarching focus in life is personal growth and intentional living. Do you want help with challenges like confidence, decision-making, or idea overwhelm? I’m a transformation coach who helps analytical thinkers get unstuck, find consistent motivation to take action, and design their life purpose. Read more about me here or my coaching practice here.