Welcome to my free cryptocurrency educational series. Each part builds on the previous ones, so I suggest starting at the beginning and moving through part by part:

Cryptocurrency 101 series (core principles, social justice, blockchain tech, Bitcoin):

- Part 0 Overview of my series, who this is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t.

- Part 1 Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

- Part 2 How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world)

- Part 3 How the blockchain keeps running, where new Bitcoins come from (i.e., how mining works), and concerns about Bitcoin’s environmental impact

- Part 4 How crypto offers autonomy, why it can’t be stopped, and the value of decentralization

- Part 5 How to store and use cryptocurrency, some basic cryptography, how wallets work, identity management, and the future of democracy

- Part 6 Overview of the different types of wallets, which one is best for you, what to be careful of, and why a hardware wallet might be worth the investment

Cryptocurrency 201 series (intermediate principles, Ethereum, NFT’s, DAO’s):

- Part 7 Ethereum (the #2 most popular cryptocurrency, and the one I’m most excited about), smart contracts, dapps, gas (and the high gas fee problem), Proof of Stake (PoS), and Ethereum 2.0

- Part 8 Coins vs. tokens, and some real Ethereum use cases—oracles and DEX’s

- Part 9 Intro to NFT’s (collectibles, research funding & historical significance, and music)

- Part 10 More categories of NFT’s (art, video games, virtual reality)

- Part 11 Wrapping up NFT’s (what you can actually do with them, upsides, downsides, risks)

- Part 12 DAO’s (organizations managed by algorithms, governance tokens, collective ownership, and the “network state”)

Cryptocurrency 301 series (advanced principles, DeFi, reinventing the finance world):

- Part 13 DeFi & CeFi, reinventing banking with peer-to-peer finance, stablecoins, and borrowing & lending

- Part 14 More DeFi (how Uniswap works, plus insurance, payments, derivatives, blockchains, exchanges, liquidity staking, and impermanent loss)

- Part 15 Wrapping up DeFi (why liquidity is important, LP tokens, yield farming, calculating return, yield aggregators, and major risks)

Cryptocurrency 401 series (investing, making money in crypto):

- Part 16 Intro to investing (what could go wrong, where you might fit in, and what kind of investing could be right for you)

- Part 17 Preparing to invest (how much money to put in, how to split it up to mitigate risk, setting up your wallets, buying the coins & tokens you want, and dealing with different blockchains)

- Part 18 More preparing to invest (security, understanding what price targets are realistic, and using “expected return” to choose between opportunities)

- Part 19 Specific investing options (buying and holding, index tokens, leveraged tokens, my list of coins and tokens, mining & staking, and lending)

- Part 20 Higher-risk, higher-reward opportunities (liquidity staking & yield farming, NFT’s, OlympusDAO, and Tomb Finance)

- Part 21 The single investment that’s made me the most money: StrongBlock

- Part 22 Wrapping up my seven categories of investment (including an update on StrongBlock)

- Part 23 How to invest depending on how much money you have (plus, the market dip, where my money is, and how to fit crypto into a larger investing strategy)

- Part 24 Holding coins & tokens vs. yield farming, where I’m putting my money now, big news on StrongBlock, and the future potential of crypto

- Part 25 Staying safe, preparing your taxes, avoiding scams, upgrading your security, and judging new projects

- Part 26 How to decide who to trust in the crypto world, technical analysis & market cycles, and an update on my longish-term portfolio

This is part 11 in my cryptocurrency educational series.

Part 11 Reading Time: 22 minutes

Want to listen to this post instead?

Last time, we explored some major categories of NFT’s and took a look at where all this might lead in the future.

But what about the world today?

What can you actually do with NFT’s? Do they just sit in your wallet, or can you display them somehow?

This is a very hot area of development right now, and we’re only at the beginning stages of use cases for NFT’s. But, here are 8 possibilities (some of these already exist and some are in development):

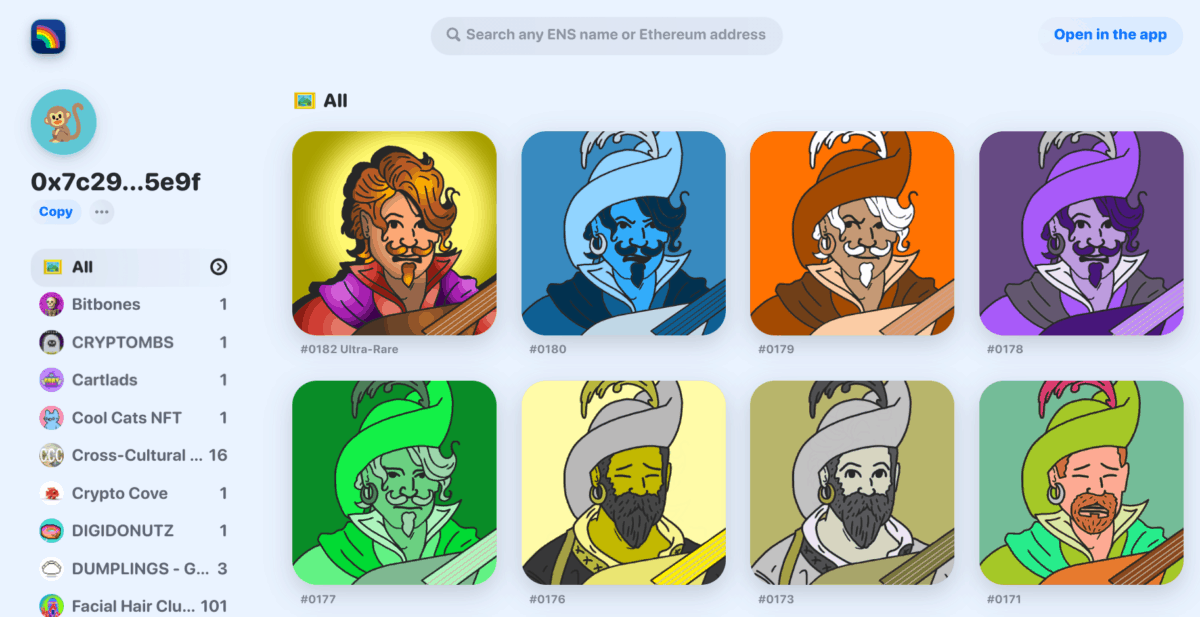

#1: Wallets and online galleries

The easiest option is to use a wallet that supports displaying NFT’s. That way, you can immediately see your NFT’s and show them off to your friends. The wallet Rainbow.me even has a “Showcase” feature where you can share the NFT’s in your wallet in an online gallery format:

Another easy option is to use whichever wallet you want and then connect it to one of the online services that already exist to show off NFT’s via an easy-to-browse gallery that you can share with friends or followers.

(All of this is non-custodial, meaning you’re not actually sending the NFT’s to the website—you’re just allowing them to link to the NFT’s inside your wallet; so, it’s perfectly safe).

Here’s an example of the service Gallery.so (the image below links to the Gallery.so page of Kevin Rose, who hosts the awesome crypto podcast Modern.Finance):

Artuego is a fancier version of that where you connect your wallet and can customize a virtual 3D space in which to display them:

10/5 edit: Oncyber is now my favorite “3D art gallery” style tool. Here are two examples: The Vincent Van Dough Gallery and Bharat Krymo’s Musée d’art. That first one is especially cool because it shows off two of the things that make this kind of experience unique compared to traditional ways of displaying art: sound and animation.

#2: Digital frames

What about the real world?

For years now, small photo frames have been available that can display digital photos. I’ve generally thought of them as a gift that Gen Y and Gen Z buys for their parents or grandparents; but, I suspect they’ll become more popular for everyone as NFT’s become more popular and as the frames themselves become thinner, higher quality, larger, and more affordable.

I’m imagining a frame more like the size of a large painting, and high enough resolution that it looks like a physical piece of art rather than a digital display.

If you had frames like that throughout your home, you might choose to have each one display the same NFT all the time (like a traditional piece of art), or you could have each one cycle through several pieces or your entire collection to keep things fresh.

I could also imagine each piece displaying a small QR code (or other indicator) in the corner. That way, visitors could scan it with their phones to find out more information about the piece—who created it, who owned it before you, and so on.

It would also turn the piece into more of a status symbol and make it clear that you were actually supporting the artist rather than displaying a counterfeit copy of the piece. In fact, the Atomic Form frame below will only display NFT’s you’re confirmed to own:

Here’s the Token Frame, another digital frame to display NFT’s from your wallet:

Some NFT’s will even be paired with custom digital frames—when you buy the NFT, the artist will ship you a frame that they specially designed to house that NFT. It might be that the custom aspect ratio of the piece wouldn’t fit a typical frame, or maybe the artist designed the aesthetic of the frame to match this particular piece.

For example, here’s Abundance, by Beeple (the artist who made that election-themed piece from the previous post). It’s an interface-free, always-on acrylic video screen of the NFT, with custom-programmed LED lights:

#3: Physical printing

An NFT could certainly be physically printed onto a variety of mediums as well.

To preserve the value and rarity, the artist might decide to code into the smart contract that the piece can only ever be officially printed (by the artist) a total of five times. Then, anyone who bought that piece in the future could look up how many times it had already been printed and thus how many were left. The prints sent out by the artist might be physically signed and labeled, say, “#2 of 5” before being sent to the NFT holder.

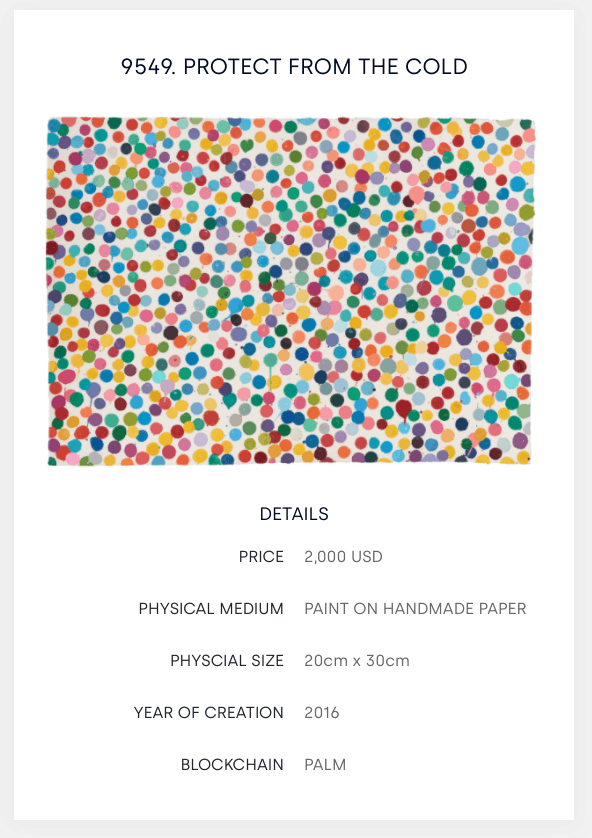

Artist Damien Hirst is taking this idea in an interesting direction with his NFT collection The Currency. He’s created 10,000 unique NFT’s that correspond to 10,000 tiny pieces of physical art stored in a vault.

When someone buys one of the pieces, they get to choose to receive it either as an NFT or as a physical piece of art. Then, the version they didn’t choose gets permanently destroyed.

Which version would you choose?

Here’s an example piece from that collection:

#4: Real-world displays

Once NFT’s become more popular, they’ll likely become a part of our personal identities.

Just as people wear certain brands of clothing or t-shirts with their favorite band on them, it might become common to have objects sprinkled around the real world for a person’s NFT’s to be displayed on.

For example, imagine sitting down at a bar or restaurant with some friends, and each table has some little screens next to it that automatically pull up NFT’s from each person’s wallet (assuming they’ve somehow marked those NFT’s as publicly accessible favorites for situations like this).

And imagine even further in the future when we have electronic fabric in our clothes—there’s already research being done on textiles that are able to display digital images.

#5: Profile pictures (PFP’s) or online avatars

Maybe you’ll decide to make your favorite NFT your Twitter profile picture or your avatar in online chat or video conferencing.

This is already happening—a lot of people are using their favorite CryptoPunk on Twitter, as you can see below.

Plus, think about how people use emojis today—each of your friends might have go-to emojis that they regularly use, so you begin to associate those with them.

Some people have even been adding emojis to their LinkedIn headlines because it provides a little flair to differentiate them and show off their personalities. In the future, you might put an NFT there instead. Here’s an interesting Twitter post with more on that idea and how people use emojis to signal their allegiances.

In June, Jay-Z changed his Twitter profile picture to a CryptoPunk (which cost him $126,000—why so expensive? because, back in 2017, the CryptoPunks collection was one of the first-ever Ethereum NFT’s, so many collectors believe they’ll have long-term historical value):

By the way, here’s something to think about: Before Jay-Z bought that CryptoPunk, there might not have been anything special about it—it was just “CryptoPunk #6095” (i.e., number 6,095 of the 10,000 that exist). But, if he kept it as his Twitter avatar for a while, people would eventually think of it not as “CryptoPunk #6095,” but as “Jay-Z’s avatar” or “the Jay-Z CryptoPunk.”

The same could be said for any celebrity who buys and publicly shows off an NFT.

It’s interesting then to imagine what happens if that famous person sells the NFT at some point. By then, it’s no longer just an NFT but more like selling part of a brand.

In the NFT world, the term “PFP’s” (profile pictures) refers to this practice of using an NFT you own as your profile picture or avatar on some social media platform.

Some people regularly swap out different NFT’s they own as their Twitter profile picture, for example. Other people have stuck to a single NFT and truly built a brand around it.

For example, @punk4156 on Twitter has built their personal brand around CryptoPunk #4156 (which they bought for $1.25M USD)—this person is completely anonymous otherwise, and they conduct interviews with voice modification software.

One more point here: A critical part of many NFT collections is the community surrounding them.

After the success of CryptoPunks, all sorts of copycat collections sprang up: penguins, cats, whales, etc.—all following the same basic format of several thousand unique characters, each with a unique combination of some hat, some sunglasses, etc.

But, most of those projects have either already failed or are unlikely to still be around a year from now. These NFT’s are only valuable if enough people believe they’re valuable; so, even if a new NFT project has great ideas, it’s bound to fail if it doesn’t attract the interest of a community of fans and supporters.

Part of being a collector, then, is feeling a sense of belonging in some community. Fans of CryptoPunks, CryptoKitties, and other successful NFT collections regularly hang out together in Discord channels to discuss the unique attributes of their punks or cats, the relative rarity of different combinations of characteristics, and other quirks of the collection.

These communities also tend to develop a kind of honor code, or at least a shared sense of not wanting to break the implicit rules. For example, if you’re a CryptoPunks fan, it’s considered not ok to make a certain punk your Twitter profile picture unless you own it.

There’s technically nothing stopping anyone from doing that since Twitter doesn’t check for ownership. But it would be like being part of the high-end fashion community and carrying around a knockoff Louis Vuitton handbag, or considering yourself a hardcore sneakerhead but wearing knockoff Nike shoes. It would feel like you hadn’t really earned that bag or those shoes. You’d probably feel like an impostor, and you’d be called out if people found out.

#6: Remixes, and use across mediums

“Remix” culture is the practice of combining or editing existing materials or works of art to create something new. For example, the 2009 novel Pride and Prejudice and Zombies is an update of Jane Austen’s 1813 classic:

Right now, companies have to threaten lawsuits against anyone who uses their intellectual property without permission—otherwise, they might lose the trademark on their brand name as Kleenex did. That’s why you don’t see many remixes of Disney characters, for example, that aren’t quickly shut down by powerful lawyers.

As a different example, let’s consider something like CryptoPunks—a set of 10,000 unique, collectible characters.

Even without NFT’s, someone could get away with using the image of their favorite CryptoPunk as their Twitter avatar. No one is likely to sue them. But what if they wanted to remix that CryptoPunk by applying their own artistic flair to it and then selling a line of clothing based on that? What if they wanted to create a comic book series based on their CryptoPunks?

At that point, the current legal structure would encourage the creators of CryptoPunks to threaten to sue that artist for profiting over intellectual property they don’t own.

But what if we reach a point where NFT’s include legal provisions to grant the buyer partial ownership of the trademark? Maybe the artist becomes legally entitled to the intellectual property of certain CryptoPunks because they purchased the NFT’s, so they can profit off sales of their new comic book or remixed t-shirt, and the original CryptoPunks creators automatically get a cut too?

The legal structures here are still being worked out, so this isn’t possible yet in the United States; but, it doesn’t seem terribly far away either. (If you’re interested in going deeper on that piece, this article has some useful information on the current legal state of NFT’s.)

Upsides, downsides, and risks of NFT’s

Like any new technology, NFT’s are going to have some awesome use cases, some sillier ones, and some issues to be dealt with.

NFT’s are exciting in a lot of ways:

- Unlike valuable assets in the physical world (like expensive paintings), NFT’s can’t be stolen by burglars, seized by the government, or destroyed in a natural disaster.

- They can’t be forged or counterfeited, and you can be absolutely sure how many were made and by whom.

- They create all sorts of new possibilities for creativity and innovation—like those trading cards tied to real-world events and rewards, or the digital art that changes based on real-world events.

- They upgrade digital assets to designate them unique (and thus make them valuable). It’s not right that an artist who creates a physical music CD or brush painting deserves proper compensation but an artist who creates an MP3 or JPEG doesn’t.

- Similarly, they bring a real sense of ownership to digital assets in video games and online worlds, including potentially offering the ability to take those assets with you from one world to another.

- They offer new models for compensation by allowing creatives, inventors, scientists—and anyone who creates anything with historical significance—to get paid for it in a way that wouldn’t have been possible before. Plus, the original artist, inventor, or creator can continue to get a cut each time the NFT is sold down the line.

- At some point, NFT’s might even be usable as collateral for loans.

- (Currently, if you want to get a loan to remodel your house or start a business, banks won’t take digital assets seriously. They’ll only accept physical goods like jewelry, even if your digital goods have real value on the market, like high-level characters in popular massively multiplayer online games. With NFT’s, this might begin to change since the technology would add a layer of security, traceability, and legitimacy to digital assets that traditional financial institutions would appreciate.).

- NFT’s can also have fractionalized ownership, meaning you and your friends could go in together on an expensive NFT and split up ownership programmatically without having to rely on the honor system or hiring a lawyer (in the next post, I’ll explain how DAO’s specifically make this possible).

- As I alluded to in Part 9, it’s possible to reward fans and owners of certain NFT’s.

- For example, here’s something that’s already happening today: Say you own an NFT from a certain artist or group. When you join their Discord (a very popular online communication service), your wallet will be checked to see if you own a relevant NFT. As a proven fan/supporter, you’ll get special privileges, entrance to VIP rooms, and early access to new things.

- Think about brands that have passionate fans—people who are willing to line up on day one to get that new phone, sneaker, or whatever else. What if that brand wanted to reward the superfan’s loyalty (say, with a limited-edition case that’s only available to people who lined up on day one)?

- In the traditional world, the brand would have to somehow gather the mailing addresses of everyone standing in line. With NFT’s, a smart contract could be easily set up to give a special token to everyone who met certain conditions (e.g., buying the product on day one); then, the brand could automatically “airdrop” a reward (say, a new NFT) into every wallet that contained that token.

- In fact, something just like that happened with Meebits—3D character NFT’s from Larva Labs, the creators of CryptoPunks. The first run of Meebits was reserved for holders of the Larva Labs’ other projects: CryptoPunks and Autoglyphs.

That said, there are also some clear downsides and risks with NFT’s that I can see:

- All this is so new—which is fun and awesome, but it also means that the rules are still being set. The blockchain tech behind most NFT’s is quite secure, so you probably don’t have to worry about an NFT suddenly disappearing or breaking down. But, at this point, everyone in the NFT space is just throwing various things at the wall to see what sticks. There’s a real possibility that a lot of the NFT’s being created today will be worth nothing a year from now, let alone ten years from now. So, please be very careful before you spend serious money on one.

- There’s a risk of art being used simply as a financial asset rather than being appreciated for its beauty and meaning. This of course already happens—wealthy people buy expensive pieces of art and keep them in a vault so they can rise in value, not even putting them up on their wall to be admired. But, NFT’s might make that even easier. Because NFT’s can so easily be traded in the same wallets you’re using to store your other cryptocurrencies, it becomes very easy to see them as just another “store of value.” I can empathize with how depressing or frustrating that must be for the artists who put so much time and energy into creating those pieces.

- A lot of NFT’s today are ridiculously expensive (e.g., the CryptoPunk that sold for $11.7 million or the CryptoKitty that sold for $172,000). But, that’s no different from many traditional collectibles and pieces of art. Part of what’s happening here too is that many artists are creating their very first NFT’s. So, they’ll hopefully charge a lot for those and then follow up with more affordable collections. Remember that NFT’s allow you to control exactly how many are created and how they can be distributed.

- Just like with all cryptocurrency, you have to be careful not to lose your private key. Otherwise, you’ll lose access to all your NFT’s with no way to recover them. (On the other hand, in some ways NFT’s are safer than traditional art—if your house burns down, you lose your paintings; but, your crypto wallet is fine if you’ve backed up your private key somewhere.)

- Seriously, please be careful. Even crypto developers make costly mistakes, like this NFT game founder who was just scammed out of $385,000 worth of NFT’s. But, he also made a fundamental mistake: He shared his seed phrase with someone online.

- Let me emphasize again: Never ever share your private key or your seed phrase. Don’t even save them in a file on your computer. Only write them down on physical paper and keep them well-hidden. They’re basically the passwords to your entire crypto bank account. The only time you should ever need them is if you somehow lose your crypto wallet and need to recreate it.

- Finally, as with all cryptocurrencies, there’s always the possibility of bugs being discovered in the smart contract that can be exploited. But, the most reputable marketplaces are regularly audited and supported by vigilant communities.

Where can you find NFT’s, and should you buy them?

Here are some places to start:

- OpenSea is the largest NFT marketplace. Others are Mintable, Rarible, and SuperRare.

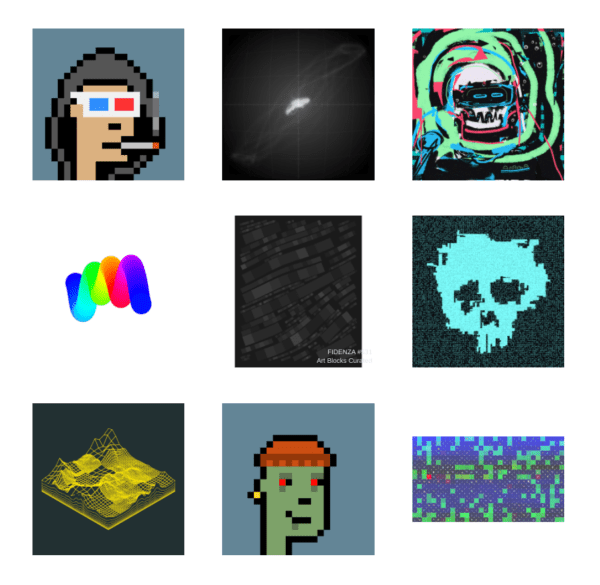

- ArtBlocks is the best source for generative art NFT’s (i.e., art created programmatically).

- Another way of buying NFT’s, particularly for investment purposes, is through NFTX and Fractional. They own NFT’s from various popular collections like CryptoPunks, and they allow you to buy just a piece of one (i.e., fractional ownership) through their Vaults, which can be helpful for a type of NFT that would normally cost thousands or millions of dollars.

- (This isn’t investment advice, but I can tell you that I put a small amount of money into a few NFTX and Fractional Vaults for the collections that I think are most likely to make good long-term holdings and hopefully go up in value: CryptoPunks, Autoglyphs, Chromie Squiggle, and Ringers. But again, I’m not terribly deep in the NFT scene myself, so I’m basing that on people I trust like Kevin Rose.)

- You can also look at NFT’s in the gaming space—for example: Axie Infinity, Sandbox, Decentraland, and Enjin.

- Finally, follow DCInvestor on Twitter—he’s an excellent source of information on crypto in general, but NFT’s in particular. (Here’s a great Twitter thread of his to start with.)

Again, please be careful with all this. I do believe that the tech behind NFT’s is going to be important, and there are a lot of interesting experiments going on here. Some NFT’s, particularly the very first ones to ever do a certain type of thing (e.g., CryptoPunks and Autoglyphs) will very likely keep their value or appreciate over time. However, the majority of NFT’s being created today probably won’t.

There’s definitely a bubble happening around this as so many artists are trying to get in on the action here, so please don’t put too much money into NFT’s as an investment. Please do consider supporting artists by buying NFT’s if you personally like them, but be very careful about doing it solely as a way of making money.

Next time, we’ll explore DAO’s, which are like corporations governed by smart contracts. They’ll tie together many of the concepts we’ve been talking about like smart contracts, NFT’s, and identity management.

P.S. Crypto is one of my newest passions, but my overarching focus in life is personal growth and intentional living. Do you want help with challenges like confidence, decision-making, or idea overwhelm? I’m a transformation coach who helps analytical thinkers get unstuck, find consistent motivation to take action, and design their life purpose. Read more about me here or my coaching practice here.