Welcome to my free cryptocurrency educational series. Each part builds on the previous ones, so I suggest starting at the beginning and moving through part by part:

Cryptocurrency 101 series (core principles, social justice, blockchain tech, Bitcoin):

- Part 0 Overview of my series, who this is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t.

- Part 1 Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

- Part 2 How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world)

- Part 3 How the blockchain keeps running, where new Bitcoins come from (i.e., how mining works), and concerns about Bitcoin’s environmental impact

- Part 4 How crypto offers autonomy, why it can’t be stopped, and the value of decentralization

- Part 5 How to store and use cryptocurrency, some basic cryptography, how wallets work, identity management, and the future of democracy

- Part 6 Overview of the different types of wallets, which one is best for you, what to be careful of, and why a hardware wallet might be worth the investment

Cryptocurrency 201 series (intermediate principles, Ethereum, NFT’s, DAO’s):

- Part 7 Ethereum (the #2 most popular cryptocurrency, and the one I’m most excited about), smart contracts, dapps, gas (and the high gas fee problem), Proof of Stake (PoS), and Ethereum 2.0

- Part 8 Coins vs. tokens, and some real Ethereum use cases—oracles and DEX’s

- Part 9 Intro to NFT’s (collectibles, research funding & historical significance, and music)

- Part 10 More categories of NFT’s (art, video games, virtual reality)

- Part 11 Wrapping up NFT’s (what you can actually do with them, upsides, downsides, risks)

- Part 12 DAO’s (organizations managed by algorithms, governance tokens, collective ownership, and the “network state”)

Cryptocurrency 301 series (advanced principles, DeFi, reinventing the finance world):

- Part 13 DeFi & CeFi, reinventing banking with peer-to-peer finance, stablecoins, and borrowing & lending

- Part 14 More DeFi (how Uniswap works, plus insurance, payments, derivatives, blockchains, exchanges, liquidity staking, and impermanent loss)

- Part 15 Wrapping up DeFi (why liquidity is important, LP tokens, yield farming, calculating return, yield aggregators, and major risks)

Cryptocurrency 401 series (investing, making money in crypto):

- Part 16 Intro to investing (what could go wrong, where you might fit in, and what kind of investing could be right for you)

- Part 17 Preparing to invest (how much money to put in, how to split it up to mitigate risk, setting up your wallets, buying the coins & tokens you want, and dealing with different blockchains)

- Part 18 More preparing to invest (security, understanding what price targets are realistic, and using “expected return” to choose between opportunities)

- Part 19 Specific investing options (buying and holding, index tokens, leveraged tokens, my list of coins and tokens, mining & staking, and lending)

- Part 20 Higher-risk, higher-reward opportunities (liquidity staking & yield farming, NFT’s, OlympusDAO, and Tomb Finance)

- Part 21 The single investment that’s made me the most money: StrongBlock

- Part 22 Wrapping up my seven categories of investment (including an update on StrongBlock)

- Part 23 How to invest depending on how much money you have (plus, the market dip, where my money is, and how to fit crypto into a larger investing strategy)

- Part 24 Holding coins & tokens vs. yield farming, where I’m putting my money now, big news on StrongBlock, and the future potential of crypto

- Part 25 Staying safe, preparing your taxes, avoiding scams, upgrading your security, and judging new projects

- Part 26 How to decide who to trust in the crypto world, technical analysis & market cycles, and an update on my longish-term portfolio

This is part 15 in my cryptocurrency educational series.

Part 15 Reading Time: 41 minutes

Want to listen to this post instead?

(11/4 Update: Significant improvements including: Clarified the difference between APR and APY; added more info about why liquidity is important to the crypto world; and added more details and screenshots to the Raydium example.)

In this post, we’ll finish up DeFi (decentralized finance) by going even deeper into liquidity staking. Then, we’ll look at the major types of risks in the DeFi space.

I highly recommend you read Part 13 and Part 14 before continuing.

(And again, I’m not an investment advisor, and this isn’t investment advice.)

DeFi use case #5b: More liquidity staking, and yield farming

In the last post, I gave you a lot of information about how platforms like Uniswap work, how liquidity pools work, and how to provide liquidity to support a platform and earn yield in return.

Before we go even deeper, let’s review and get on the same page with some core concepts:

First of all, when I use the word “yield” in this post, it simply refers to the return you get on your investment. For example, if you invested $1,000 into an investment opportunity with a yield (or APR) of 10%, that means that after a year it would be worth $1,100. If you wanted to calculate the monthly return, you could divide that 10% by 12.

There are two important relevant acronyms that people sometimes confuse: APR (annual percentage rate) and APY (annual percentage yield) both refer to annual return. But the difference is that APY includes compound interest—in other words, instead of cashing that interest out, you reinvest it as you go for even more gains.

This post is going to get a bit complicated. So why would someone put in all the effort required to understand liquidity staking and yield farming?

Because the yields can be incredible.

Like I’ve said in previous posts, the average APR of a savings account in the United States is only 0.06%, whereas many of these liquidity staking strategies will yield APR’s more like 10%, 50%, or even higher, depending on the level of risk. That’s hundreds of times higher than a savings account, and it’s why a lot of people think it’s worth it to navigate all this complexity.

To review, the basic idea behind liquidity staking is this:

- Decentralized exchanges (DEX’s) like Uniswap or Sushiswap allow users to swap one coin or token for another. Because DEX’s are decentralized, they don’t have their own vault full of all the coins and tokens necessary to do that. So, they rely on users to provide the liquidity (i.e., the ability to quickly swap one cryptocurrency for another) by lending the platform some of their assets.

- When you provide liquidity to one of these platforms, you’re agreeing to lock up some of your cryptocurrency, which means you can’t use it. You’re instead allowing that platform’s smart contracts to use your coins or tokens.

- In return, you get passive income for as long as you leave those assets locked in. There are variations (e.g., providing liquidity with two tokens versus staking a single token); but, it all comes down to supporting a platform by lending them your cryptocurrency and being rewarded for doing so.

Remember that when you provide liquidity to, for example, the USDC/ETH pool on a DEX, you’re lending them equal amounts of your USDC and ETH. When enough people do that, it gives the DEX the ability to provide its primary service: allowing users to exchange one coin or token (e.g., USDC) for another (e.g., ETH). In return, the DEX gives you a cut of the fees they charge those users.

Typically, by lending out your assets to the platform, you wouldn’t be able to use them because they’d be locked up. But, a relatively new innovation is that many DeFi platforms have added an interesting additional element: LP tokens.

On these platforms, when you provide liquidity, the platform gives you some LP tokens (liquidity provider tokens) as a kind of receipt or IOU, proving that a certain percentage of the USDC and ETH in that pool is yours. In this example, the LP tokens might be called something like “USDC-ETH LP” (i.e., that would be the name of the token that appears in your MetaMask when your USDC and ETH disappears).

When you ultimately decide to stop providing liquidity, you swap your LP tokens back for your original assets, plus your cut of the fees.

LP tokens allow for even more complex and lucrative strategies like yield farming.

There are a lot of complex (and sometimes highly lucrative) strategies in the DeFi community centered around LP tokens. It’s all basically a way of incentivizing people to lend their cryptocurrency on a certain platform to keep everything on that platform running smoothly.

We’ve already covered the foundational piece: Pools on a DEX (decentralized exchange) need liquidity in order for that DEX to actually act as an exchange—in other words, to make sure it has enough of a certain token pair so that users can swap one for the other.

But why do I keep coming back to that?

Why is liquidity important? Why is it important for people to be able to easily swap one coin or token for another?

Here are two big reasons:

First, providing liquidity to decentralized exchanges (like Uniswap) allows them to compete with centralized exchanges (like Coinbase). As I’ve explained in previous posts (like Part 4), one of the most important philosophies behind crypo is decentralization, meaning that power is spread out across a lot of groups and people instead of being only in the hands of a single entity.

Second, remember that since Ethereum and other newer blockchains are programmable, a token isn’t just a currency. It’s also part of a dapp or platform that provides real functionality—anything from lending money, to minting NFT’s, to providing oracle services, to running gaming worlds.

So, helping more people access a new platform’s token will directly support its growth. If there’s greater liquidity, it means it’s easier for people to get that coin or token when they want it.

Let’s explore that specific use case of supporting a new platform’s growth.

Say a group creates a new crypto platform that has a token, and they want people to start using it.

For example, when Uniswap was created, they released the UNI token, which people could buy to support the platform, participate in its governance, and share the platform’s profits.

But how does a brand new project get the public to buy its token?

First, they’ll need some way to pay for it. And how will most people in the crypto world want to do that? By using their existing cryptocurrencies like ETH or USDC.

So, they’ll need a way to swap ETH or USDC for the new token. But, DEX’s will have very low liquidity on that new token at first since very few people own it. Remember that DEX’s are entirely dependent on users to provide liquidity, so at first the liquidity pool will be empty.

The creators might need to try different things to incentivize people to provide liquidity (i.e., to buy some of the new token directly from the creators’ website, then lend it to a pool on Uniswap, or whichever DEX).

By providing liquidity on that new token, you’re putting in more work and taking on more risk, which is why you’re rewarded quite well with some of the highest APR’s in the crypto world.

Here’s how all this might work:

- Let’s say you hear about a new early-stage cryptocurrency project, and you want to get in on the action. You visit the project’s website, where the creators are giving away or selling the new token (or providing instructions on how early adopters can run a node to mine it, etc.). This process is typically referred to as an ICO, or “initial coin offering”—when a brand new cryptocurrency is first available to investors (whether through the project’s website or through a centralized exchange like Coinbase or Binance).

- The creators ask these new investors to provide liquidity by staking their new tokens in a brand new pool on Uniswap (or whichever DEX the creators choose). They’ll probably start with a pool for ETH/NEW-TOKEN. That way, once you and the other early adopters have provided enough liquidity, other people will be able to easily swap their ETH for this new token.

- When you provide liquidity on the ETH/NEW-TOKEN pair (i.e., contribute to that pool), Uniswap gives you LP tokens representing that pairing. In other words, you now have proof that you did your part and contributed to the success of the new project. And just like with all blockchain-based tech, this proof is pretty much impossible to forge. But, it’s also trustless, meaning that the token creators know that you contributed to the project even though you’re completely anonymous.

- Now, when you go back to the project’s website, it offers you the ability to “farm” your LP tokens—which means staking them (i.e., holding them) there for a high APR (annual percentage rate of return). This is to incentivize you to keep providing liquidity since the longer you do, the more money your LP token will generate for you. Staking your LP tokens in this way is called “yield farming”—I imagine because it’s like you’ve planted seeds that stay put in the ground and consistently return yield.

- Then, whenever you feel done, you unstake your LP token, return to Uniswap, and swap that LP token back for your original ETH and NEW-TOKEN assets.

As you might imagine, as you stack these strategies, the rewards can increase, but so too does the complexity and risk.

You’re not alone if it’s hard to wrap your head around all this—I still get confused here.

So, let’s go through everything again, step by step. I’ll bold all the fancy terms along the way to help clarify the difference between each one. Also, keep in mind that much of this applies to many different DeFi platforms; but, there will be some small (and large) variations between them. So, please do your homework before investing.

Let’s try again from the top, step by step (with key definitions bolded):

- In the DeFi space, decentralized exchanges (DEX’s) allow users to exchange one type of coin or token (e.g., ETH) for another (e.g., UNI).

- To do that, they rely on liquidity—having enough of the desired token (e.g., UNI) available to trade you for the token you have (e.g., ETH).

- Where does that liquidity come from? Users who provide liquidity to the DEX by entrusting it with some of their cryptocurrency.

- This is also known as liquidity staking because it’s similar to the “staking” that node owners do to keep a blockchain network like Ethereum running—where they lock up some of their ETH in a vault for a certain period of time to demonstrate their trust in the network and receive rewards in exchange.

- Note: I’m not sure why this one thing has developed so many synonyms floating around out there, but all three of the following are the same: “liquidity staking,” “liquidity mining,” and “providing liquidity.” This is especially confusing because “mining” and “staking” are different—mining is associated with proof-of-work algorithms (which Bitcoin uses), and staking is associated with proof-of-stake algorithms (which Ethereum 2.0 uses).

- When you provide liquidity, you typically do so via a pair of tokens (though there are some platforms that only require you to provide one of the tokens rather than both).

- That means you give the DEX two different cryptocurrencies (e.g., ETH and UNI) in equal proportion by value (e.g., if 1 ETH = 200 UNI, you might choose to provide 0.5 ETH and 100 UNI or 5 ETH and 1,000 UNI).

- Each token pair is represented in a liquidity pool. This is the pool of all the tokens that fellow users have entrusted to the platform to provide the liquidity that can be used to make the exchanges that other users want.

- In other words, in order for a DEX to allow regular users to swap their ETH for UNI tokens, that DEX will need an ETH/UNI liquidity pool with enough UNI available.

- Why would you provide liquidity to a pool? Because every time a user uses a DEX to make an exchange, they’re charged a small fee, and those fees go to the associated pool.

- So, if someone used a DEX to exchange ETH for UNI, the fee they paid would be divided up between all the people who had provided liquidity in the ETH/UNI pool.

- Also, by providing liquidity, you’re given LP tokens (liquidity provider tokens). These represent your share of the liquidity pool.

- So, if you’ve provided 10% of the liquidity in a pool, you’d get 10% of all the LP tokens associated with that pool.

- Remember that you never share your identity with the DEX, so those LP tokens are how you prove it was you who provided that liquidity.

- When you want to get your original cryptocurrency back, you exchange the LP tokens for your original crypto.

- Without LP tokens, your crypto would be locked into that pool until you removed it. But LP tokens allow you to indirectly use it even while it’s busy providing liquidity.

- How? By putting the LP tokens to work. That’s called yield farming—when you take an LP token from one DeFi platform and invest it in a pool or another DeFi platform. The rewards you get from reinvesting your LP tokens are called farming yields.

- DeFi platforms give you rewards on your LP tokens as a way to incentivize you to keep providing liquidity on their platform.

- For example, if you provide liquidity on the Raydium platform and receive RAY tokens, you can then farm those for additional yield to incentivize you to provide the liquidity to Raydium that keeps it running.

- When you feel done, you can bring your LP tokens (plus any farming yields) back to your original DeFi platform to exchange them back for your original assets. Or, you could even gift or sell your LP tokens to someone else.

- Your original assets aren’t tied to your wallet, but to those LP tokens. The tokens are kind of like an IOU for your original ETH and UNI (or whichever tokens).

- So, that IOU is essentially worth the total value of your original ETH and UNI (plus your portion of the fees that have been accumulating in that pool).

- When you do turn in your IOU (LP token) at the original pool to get your assets back, you’ll typically get an equal share of each of the paired assets (e.g., $500 worth of ETH and $500 worth of UNI).

Here’s a real example of the above:

- Let’s say you own the tokens USDC and RAY (the token of Raydium, a popular DEX on the Solana network, which I’ve personally been using since Ethereum gas fees are so high right now). But, you don’t want them to just sit in your wallet. You want to put those tokens to work to make you more money—and, at the same time, you’ll be supporting the Raydium platform.

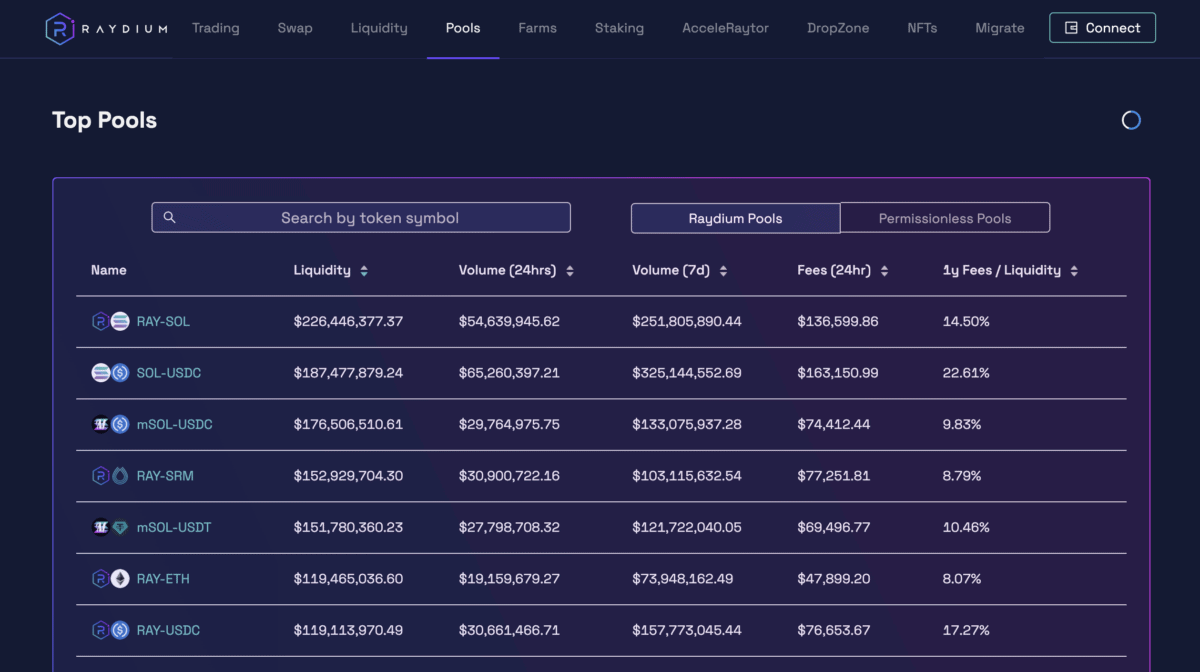

- To do that, you start by visiting the Raydium dapp and browsing the list of pools. By the way, if at this point all you had was USDC, you could visit Raydium’s Swap page to swap half of your USDC for RAY.

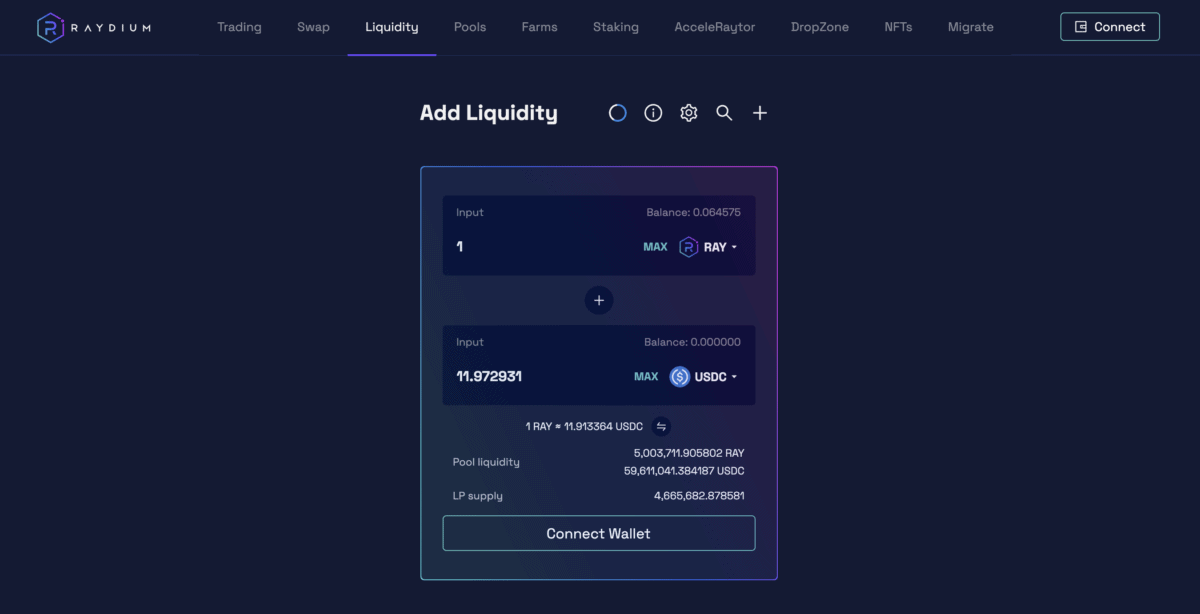

- On the Pools page, you’ll see a pool for RAY-USDC. Click that, and you’ll arrive at the Add Liquidity screen. It’ll ask you to enter how much RAY and how much USDC you want to contribute. Once you connect your wallet, it’ll show you how much you have of each. If I enter 1 RAY, it’ll automatically fill in 11.97 USDC (or whatever the current price of RAY is) so that you’re contributing an equal value of both tokens.

- Once you complete that transaction, you’ll see an LP token called RAY-USDC LP appear in your wallet. Or, sometimes, you won’t actually see it in your wallet, but you will see your LP tokens in the dapp in the next step.

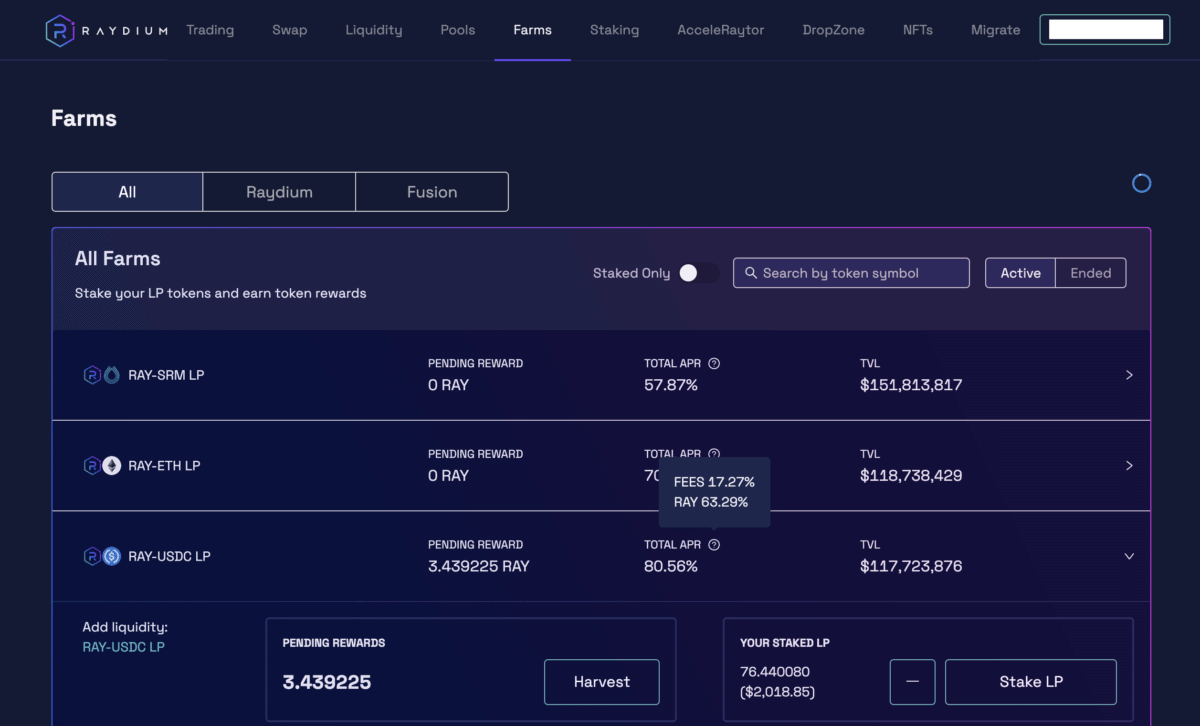

- From there, you can go to the Farms page and the RAY-USDC LP farm. The Total APR listed (80.56% here) is the total yield you can expect to earn from this entire process, including both providing liquidity and farming the LP token. In fact, Raydium has a great interface that allows you to hover over the APR, and it’ll tell you what percentage of that yield is the fees from providing liquidity (17.27% here), and what percentage is from farming/staking the LP token (63.29% here). In the screenshot, you can see that I have 76.44 LP tokens currently farming, which is valued at $2,018 USD. The farm has generated 3.43 RAY tokens for me so far that are ready to harvest whenever I want.

- Typically at some regular interval you decide (say, daily, weekly, or monthly), you can go back to this page, expand the RAY-USDC LP box, and click Harvest, to send your rewards to your wallet. These will be in the form of RAY tokens, which you can either (a) re-stake in this same farm to compound your gains, or (b) swap them on the Liquidity page for USDC or whichever cryptocurrency you’d like.

- To be clear, when you harvest, you’ll receive RAY tokens, not RAY-USDC LP tokens. So, if you want to re-stake your rewards into the farm, you’ll first have to harvest the RAY tokens, then go to the Swap page to convert half of those RAY tokens to USDC, then go back to the Liquidity page to get more LP tokens by providing more liquidity with half RAY and half USDC, then finally you can come back here to re-stake those new LP tokens.

- How often should you be harvesting your rewards and re-staking? Well, the more often you do it, the more you’ll compound your gains. But, the downside is more work for you, plus there’s a gas fee every time you harvest, and another one every time you re-stake into the farm. Luckily though, on non-Ethereum blockchains like Solana, that gas fee is less than $1 USD, and often just pennies.

Phew. If your head is spinning right now, that’s completely normal.

You can make a lot of money here if you’re smart and careful, but it’s not simple.

I suggest you read this post and the previous one several times before attempting any of this. And even then, you might want to also search for some YouTube videos that walk you step-by-step through the specific DEX you’re interested in working with.

There are so many pools out there. How should you choose where to provide liquidity?

I’m still exploring this question myself, but here’s my advice so far:

- Start by researching DeFi platforms with liquidity pools, and decide which platforms you trust. Remember that if they get hacked or their smart contracts fail for some reason, you could lose all the assets that you’ve put into the pool. Personally, here’s my current list of platforms I’m willing to use:

- Uniswap (Ethereum network)

- Sushiswap (Ethereum network)

- Bancor (Ethereum network)

- Curve (Ethereum or Polygon networks)

- Beefy (Ethereum or Polygon networks)

- Balancer (Ethereum or Polygon networks)

- Terraswap (Terra network)

- Plenty (Tezos network)

- Raydium (Solana network)

- PancakeSwap (Binance Smart Chain network)

- Explore the pool offerings.

- High APR’s are appealing of course, but they often come with more risk.

- Be very careful with impermanent loss (remember that that’s when the value of one or both of the coins or tokens you’re providing liquidity on changes value and you would have been better off just holding those in your wallet rather than providing liquidity). I still haven’t figured out a reliable way of finding pools with a good record of low impermanent loss (other than by using Bancor, because it allows you to provide single-sided liquidity via just one coin or token rather than a pair); but, I encourage you to do your own research and experiment with the various calculators out there.

- Make sure you understand that platform and pool’s fees and rules as well. For example, some platforms might charge you a fee for removing liquidity too soon, and some might offer you bonuses for providing liquidity for at least a certain amount of time.

- Curve even has a system that offers you higher rewards on liquidity providing if you buy some of their CRV token and stake it on their system in a way that locks it in for several years. (I personally trust Curve a lot, so I’ve locked in a small number of CRV tokens.)

- Decide which coin or token pairs you’d feel comfortable providing liquidity for.

- This step is often overlooked as people chase the highest-APR pools. But be very careful here: If you provide liquidity on a pool with two tokens you’ve never heard of, even an APR of 1,000% won’t matter if those tokens turn out to be useless and their prices dramatically fall.

- So, my usual policy is to only provide liquidity on token pairs or stablecoins that I believe have real value—things like ETH, LINK, AAVE, UNI, USDC, DAI, etc.

How do you calculate your return on all this?

It can get very confusing, but here’s a basic way to start thinking about it:

- Remember that when you provide liquidity to a DEX, you’re rewarded with a percentage of the fees that users pay when they use that DEX to exchange the pair of tokens you’re providing liquidity on. So, your total return is that APR minus any impermanent loss (which I explained in detail in Part 14; and, again, impermanent loss will be lessened if you’re providing liquidity on stablecoins or other token pairs whose prices won’t diverge much).

- When you farm the LP token you received from the previous step, you get additional APR (or APY if it’s auto-compounding as it can be on dapps like PancakeSwap, or if you regularly manually reinvest rewards yourself). So, your total return = liquidity APR – impermanent loss + farming APR.

- You can use websites like YieldWatch to track how much money you’ve made on your liquidity staking.

By the way, it’s also important to remember that many of the extremely high APY’s we’re seeing right now in DeFi won’t last.

For example, at the time of this writing, that RAY-USDC pair on Raydium has such a high yield because they really need liquidity right now—in other words, there’s a lot of demand for that pair, and their pool is running low. But, as more people provide liquidity, the rewards will go down.

And at a higher level, as a platform gets more popular, they have less need to lure people in with amazing farming opportunities. So again, that’s why some people in the crypto space jump from opportunity to opportunity to seek the highest yield as new platforms open up.

One more thing: “yield aggregator” platforms like Yearn and Curve can simplify and automate some of this, but you have to be careful.

Yield aggregators can, for example, automatically reinvest returns for you or invest the LP token from one platform on another to increase yield. In short, they can execute a complex strategy with just one or two clicks to connect your wallet and give the smart contract some of your ETH to work with.

This sounds nice of course, but keep in mind that it’s easy to ignore some of the risks when everything is presented in such a convenient package. If Yearn is executing transactions for you across multiple DeFi platforms, you’re stacking the risks from each one on top of each other. If any one link in the chain fails, the whole thing could collapse.

It can also be confusing to figure out your return. Typically, the total APY you’ll get is what’s shown on the final step of the process rather than what you’d get by manually adding the APR for each step along the way. In other words, the APY reported on Yearn or Curve takes into account all the profits you make at each step along the way.

For example, I’ll briefly describe a strategy using both the Yearn and Curve platforms where you can provide liquidity on Curve’s stETH pool. That pool offers a return of 3.02% (at the time of this writing) and gives you the crvSTETH token. You can then put that token into Yearn’s crvSTETH vault, which auto-compounds it for you, offering an APY of 5.18%. In this case, you don’t add those two numbers—the latter, 5.18% is your total return.

Before you jump into any of this, though, you need to understand the risks.

Risks in DeFi:

As you can see, DeFi is a very deep rabbit hole to go down. There are opportunities to make a lot of money; and, I myself have made some costly mistakes as well.

Here are the main things that you need to be careful of as you explore this space:

Risk #1: Scams—there are a lot of people and websites out there that might try to trick you, so please be very, very careful.

- Never share your private key or seed phrase with anyone, even if they claim to work for MetaMask, Coinbase, or whatever else. That is literally like giving them the key to your bank vault.

- I’ve read about all sorts of unfortunate situations where a person complains about their wallet not working, then someone direct messages them on Reddit or Discord claiming to be in a customer support role. They might not even ask for your private key directly. They might, for example, ask you to share your screen so they can help you fix your issue; then, they use subtle tricks to have you click something that shows a QR code, for example, that they’d need to gain access to your cryptocurrency.

- Always check the URL to make sure you’re on the real Uniswap (or whichever DeFi platform). In your browser, the URL should always start with “https” (‘s’ for secure), and it should have a lock icon at the front. It’s not as hard as you’d think to create a fake copy of a website that looks real, and one of the only ways you might be able to tell for sure is by checking the URL.

Risk #2: Bugs and hacks—the smart contracts governing these platforms are all programmed by fallible humans.

- DeFi platforms are frequently targeted by hackers. Over $1B has been stolen by hackers from DeFi platforms in 2021 alone. I don’t want to scare you away from DeFi, but I do want to balance out all the YouTube videos telling you how “easy” it is to get rich here. I’ll go over some important safety precautions in my next few posts on investing.

- The teams behind the best DeFi platforms tend to be very good at finding bugs and fixing them quickly. But, it’s always possible that a catastrophic bug will be discovered that gives hackers a way in. That’s why many of these platforms offer bug bounties—monetary rewards for people who discover bugs and report them.

- It’s worth stressing again here that the laws around crypto are still being worked out. Legally speaking, it’s not entirely clear who’s responsible if your investment is lost due to a hack or smart contract failure. In other words, don’t expect the police to help you out if your money is lost in DeFi.

- That said, the teams behind the top DeFi products are highly professional, managing millions or billions of dollars worth of assets, so I personally don’t worry about hacks and bugs too much if I’ve picked a quality project with an experienced team behind it. Still, risk management and diversification are important—don’t put all your money in any single DeFi project.

- One last thing worth naming here: Some yield farmers are willing to jump through a lot of complex hoops to chase the highest possible yield. For example, they might borrow from one DeFi platform to invest in a different DeFi platform, then use that token to invest in a third platform. Please recognize that each time you jump from one platform to another (or add an additional coin or token to your strategy), you’re exposing yourself to another layer of risk. If any one of those smart contracts or coins fails in any way, your entire house of cards could come crashing down.

Risk #3: High gas fees—as crypto has been exploding in popularity lately, gas fees have gotten extremely expensive.

- There’s a lot of work being done to address this, but it’s pretty bad right now. If you’re investing tens of thousands of dollars, this won’t be a big deal. But if you’re trying to invest $100 in DeFi, you might eat up half or more of that in gas fees alone. Then, it won’t matter if some investment opportunity is promising 40% returns if you’ve already lost 50% on fees.

- So, one tip here is to batch your transactions as much as you can. For example, instead of providing some liquidity to a pool today and more tomorrow, wait till tomorrow to do it all at once. Of course, the downside is that you might be taking on more risk by going all in this way.

- An even better way around high gas fees is to explore DeFi opportunities on less-popular blockchains like Solana, Tezos, or Fantom (i.e., not Ethereum).

Risk #4: “Rug pulls”—when the team behind a DeFi platform intentionally misleads users to steal their money.

- Malicious individuals or teams lure people in by advertising amazingly high interest rates (500% APY! 2,000%!), and once enough people have invested their money, the team will suddenly shut down the platform or use other technical or financial tricks to disappear with the funds.

- The best way to guard against this is to only use DeFi platforms that have undergone third-party audits and that are well-respected in the DeFi community. A great place to start your research is DeFi Pulse’s list of popular DeFi products—ideally, make sure the platform you’re considering is in the top 10, or even top 30 of the rankings. You should be pretty safe with all of those (but who knows—I haven’t personally researched all of them). You can also try searching on Google or Reddit for things like “[DeFi platform name] scam” or “is [DeFi platform name] safe.”

Risk #5: Foundational risks—any DeFi platform would be greatly affected if its underlying blockchain or stablecoins had issues.

- For example, if a major bug were discovered in Ethereum, any DeFi platform running on that blockchain would be at risk. Ethereum is very stable at this point, so I don’t worry so much about this (though it’s still always a possibility, and you still need to take security seriously). But be especially careful with brand new blockchains that are advertising amazing opportunities to make money.

- What I worry more about is the stablecoins that many DeFi platforms depend on. For example, what happens if most of the tokens for a DeFi platform were purchased using the stablecoin USDT, and news comes out that USDT isn’t fully backed by US dollars as its creators claimed? Or, what if a DeFi platform depends on the algorithmically derived stablecoin UST, and something goes wrong that causes it to lose its peg, so it’s no longer 1:1 with the US dollar?

- Here’s my personal order of most trusted stablecoins (which is highly subjective and based more on my gut than extensive research): USDC, UST, DAI, GUSD.

- It’s also important to pay attention to which token you’re getting your rewards paid out in (e.g., for providing liquidity or farming). You’re a lot better off receiving a reputable token like ETH, SUSHI, SOL, LUNA, etc. than some brand new token that hasn’t proven itself yet. Even if you’ve received a lot of rewards in a certain token, until you’ve converted it to something safe like ETH or USDC, you’re at risk of that token suddenly decreasing in value at any moment.

- One easy way to check if a coin or token is safe and valuable is to see where it ranks on CoinGecko (either sorted by # or by market cap). Something in the top 20 will be a lot safer than one ranked in the five hundreds (or that has no rank at all). But, keep in mind that there are also some pretty crappy coins in the top 20 too that are driven by hype or memes rather than sound fundamentals.

- To summarize all these foundational risks, think about the Raydium liquidity staking and farming example from earlier. Here are just a few ways that could go wrong:

- Since we’re providing liquidity on the RAY-USDC pair in that example, we have two points of failure right there: USDC could lose its peg to the US dollar or RAY could suddenly decline in value (and remember that the rewards are in the form of RAY, so you’ve gained nothing if that goes down too much).

- We’re providing liquidity on the Raydium platform, whose smart contracts could be hacked or buggy.

- The Raydium platform runs on the Solana blockchain network, and if the value of SOL (Solana) suddenly dropped (or the network were otherwise attacked), people could lose faith in the entire Solana blockchain ecosystem.

- If ETH or another famous cryptocurrency had a sudden drop in price or a major bug were discovered, people might temporarily lose faith in the crypto world in general, including dapps on the Solana network.

Risk #6: User error—I’ve put hundreds of hours into researching this stuff, and I still find a lot of it confusing.

- Please make sure you really understand how something works—including all the fees—before you invest in it. Simple lending on something like Aave or BlockFi is pretty easy and low-risk. But providing liquidity on a DEX is a lot more challenging and easy to mess up.

- When you get a loan from a bank, the bank loan specialist guides you through the process. When you get a loan through DeFi, it’s just you and the dapp. If you send your cryptocurrency to the wrong address, it’s gone forever. If you lose your private key or seed phrase, your wallet is gone. There’s no password reset.

- There are all sorts of mistakes you could make:

- Clicking the wrong button;

- Sending a token to a wallet that doesn’t support it;

- Accidentally sending more or less money than you intended;

- Dramatically underestimating all the fees involved (remember that more gas is required for more complex transactions);

- Getting confused at step 5 of a complex 8-step strategy, and not knowing how to get your money back;

- Being tricked by a scammer who directs you to a fake version of the DeFi website you’re trying to use; and so on.

So yes, a lot of these DeFi strategies return amazing yields. But there are a whole lot of ways you could lose your money too.

Most DeFi dapps don’t have very strong guardrails. So please read the documentation, watch tutorial videos, double-check all the numbers and wallet addresses you enter, and move slowly—start with a small amount of money to make sure you’re doing everything right.

And again, especially if you find an opportunity in DeFi that’s promising incredible returns, please slow down and do your research to make sure you’re not missing something. Is this too good to be true?

Where does all this leave the TradFi industry (i.e., regular banks and financial institutions)?

As we wrap up here, you might be asking yourself: DeFi seems amazing—will traditional banks and financial institutions go out of business?

It’s certainly possible at some point. But what’s more likely to happen in the short term—and what’s already started happening—is that traditional financial institutions will get in on all this and invest in crypto-based financial products. Then, they’ll wrap up those investment opportunities in easier-to-use interfaces, slap their logo on it so it seems more trustworthy, and charge a premium.

Let’s say a bank is able to get 5% yield on a crypto platform. To the average bank customer who doesn’t understand crypto, even an interest rate of 2% on their savings account would be absolutely amazing compared to the 0.06% they’re used to; so, the bank could give them that 2% and take the remaining 3% as profit.

I’m not saying that’s necessarily ethically wrong, either. This stuff is complicated and it’s easy to make mistakes, especially for people who aren’t tech-savvy. So it makes sense for someone to play the role of middle-man—making things easier, providing a sense of security, and charging a premium for it.

But, if you can just invest directly in DeFi yourself, you’ll of course make more money. And, hopefully, what we’re doing here in the DeFi space is not just profiting, but also reinventing the financial industry to be more open, transparent, fair, and accessible to everyone.

So, I personally hope that DeFi platforms keep innovating so that they become so easy to use that even less tech-savvy people can get on there themselves without needing a bank to act as a middle-man. Progress is definitely being made here since some of the newer DeFi products are a lot more user-friendly than the first generation.

Phew, that’s it for DeFi—the fifth major use case of Ethereum, and the last one I’ll be covering for now.

Now that you have a solid foundation in crypto, we’ll move on to how to invest in this space. In the next few posts, I’ll explain what to be careful of when investing in crypto, where I’ve chosen to invest my money, and some other tips and tricks that I wish I’d known back when I got started.

P.S. Crypto is one of my newest passions, but my overarching focus in life is personal growth and intentional living. Do you want help with challenges like confidence, decision-making, or idea overwhelm? I’m a transformation coach who helps analytical thinkers get unstuck, find consistent motivation to take action, and design their life purpose. Read more about me here or my coaching practice here.