Welcome to my free cryptocurrency educational series. Each part builds on the previous ones, so I suggest starting at the beginning and moving through part by part:

Cryptocurrency 101 series (core principles, social justice, blockchain tech, Bitcoin):

- Part 0 Overview of my series, who this is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t.

- Part 1 Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

- Part 2 How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world)

- Part 3 How the blockchain keeps running, where new Bitcoins come from (i.e., how mining works), and concerns about Bitcoin’s environmental impact

- Part 4 How crypto offers autonomy, why it can’t be stopped, and the value of decentralization

- Part 5 How to store and use cryptocurrency, some basic cryptography, how wallets work, identity management, and the future of democracy

- Part 6 Overview of the different types of wallets, which one is best for you, what to be careful of, and why a hardware wallet might be worth the investment

Cryptocurrency 201 series (intermediate principles, Ethereum, NFT’s, DAO’s):

- Part 7 Ethereum (the #2 most popular cryptocurrency, and the one I’m most excited about), smart contracts, dapps, gas (and the high gas fee problem), Proof of Stake (PoS), and Ethereum 2.0

- Part 8 Coins vs. tokens, and some real Ethereum use cases—oracles and DEX’s

- Part 9 Intro to NFT’s (collectibles, research funding & historical significance, and music)

- Part 10 More categories of NFT’s (art, video games, virtual reality)

- Part 11 Wrapping up NFT’s (what you can actually do with them, upsides, downsides, risks)

- Part 12 DAO’s (organizations managed by algorithms, governance tokens, collective ownership, and the “network state”)

Cryptocurrency 301 series (advanced principles, DeFi, reinventing the finance world):

- Part 13 DeFi & CeFi, reinventing banking with peer-to-peer finance, stablecoins, and borrowing & lending

- Part 14 More DeFi (how Uniswap works, plus insurance, payments, derivatives, blockchains, exchanges, liquidity staking, and impermanent loss)

- Part 15 Wrapping up DeFi (why liquidity is important, LP tokens, yield farming, calculating return, yield aggregators, and major risks)

Cryptocurrency 401 series (investing, making money in crypto):

- Part 16 Intro to investing (what could go wrong, where you might fit in, and what kind of investing could be right for you)

- Part 17 Preparing to invest (how much money to put in, how to split it up to mitigate risk, setting up your wallets, buying the coins & tokens you want, and dealing with different blockchains)

- Part 18 More preparing to invest (security, understanding what price targets are realistic, and using “expected return” to choose between opportunities)

- Part 19 Specific investing options (buying and holding, index tokens, leveraged tokens, my list of coins and tokens, mining & staking, and lending)

- Part 20 Higher-risk, higher-reward opportunities (liquidity staking & yield farming, NFT’s, OlympusDAO, and Tomb Finance)

- Part 21 The single investment that’s made me the most money: StrongBlock

- Part 22 Wrapping up my seven categories of investment (including an update on StrongBlock)

- Part 23 How to invest depending on how much money you have (plus, the market dip, where my money is, and how to fit crypto into a larger investing strategy)

- Part 24 Holding coins & tokens vs. yield farming, where I’m putting my money now, big news on StrongBlock, and the future potential of crypto

- Part 25 Staying safe, preparing your taxes, avoiding scams, upgrading your security, and judging new projects

- Part 26 How to decide who to trust in the crypto world, technical analysis & market cycles, and an update on my longish-term portfolio

This is part 22 in my cryptocurrency educational series.

Part 22 Reading Time: 25 minutes

Want to listen to this post instead?

1/27 Update: Added a new “Update on StrongBlock” section.

1/29: Added a couple more things to the “Update on StrongBlock” section.

1/30: This post was getting too long with those updates, so I split some of it into Part 23. I also added one more tip to the “Update on OlympusDAO” section.

1/31 I added some more about risk management at the end.

This is my seventh post specifically about investing in crypto, so I highly recommend you start with the previous ones if you haven’t read them yet:

- Part 16 (“Intro to investing)

- Part 17 (“Preparing to invest”)

- Part 18 (“More preparing to invest”)

- Part 19 (“Specific investing options”)

- Part 20 (“Higher-risk, higher-reward opportunities”)

- Part 21 (“StrongBlock”)

In Part 21, I did a deep-dive into the single investment that’s made me the most money: StrongBlock.

Today, I’m going to wrap up the seven categories of investment that I’ve been describing over the past few episodes—first by adding some more information on categories six and seven, and then by putting all seven categories into perspective.

(Disclaimer: I’m not an investment advisor, so please don’t see this series as me telling you to invest a certain way. Instead, this is my attempt to thoroughly explain all the major options available to you in the crypto world so you can make your own choices. Many of these will not be right for every person, and I don’t know your individual situation.

As I described in the last couple of posts, categories #6 (DeFi 2.0) and #7 (StrongBlock) offer outrageous APY’s.

Remember that the average savings account offers 0.06% per year, and the stock market has returned around 10% per year. With investments like StrongBlock and OlympusDAO, we’re talking about making 1% or more per day.

Usually, when something in crypto seems too good to be true, it probably is.

In this case, though, I can attest that these opportunities have been legitimate. I personally have been in StrongBlock for eight months and OlympusDAO for three months, and they’ve largely delivered as advertised (though that’s been changing recently for OlympusDAO in particular).

But again, even though they’ve been two of my most profitable investments by far, I’ve been very careful with my risk mitigation and asset allocation. I started out with small positions in each and grew them over time.

With all the OlympusDAO copies and other “DeFi 2.0” options to choose from (and newer ones every day touting even more outrageous APY’s), it can be hard to decide where to put your money.

If I had to rank the options that I described in my categories #6 and 7, this would be my personal order:

- StrongBlock (on Ethereum)

- OlympusDAO (on Ethereum)

- Tomb Finance (on Fantom)

- Hector DAO (on Fantom)

- Wonderland (on Avalanche)

- 1/27 Update: There’s been a lot of sudden controversy and revelations lately about Wonderland. I’m not sure how it will turn out, but I personally would not invest in it at this point. Like I’ve said many times, remember that this stuff is high-risk and you should not be investing in it unless you’re keeping your position sizes small and following the news so you can adapt as needed. (And when I say “news” here, I’m talking less about mainstream finance publications like Bloomberg and more about what actual crypto experts are saying on Twitter and Reddit. I’ll explain sometime in the next few posts about how you might choose who to trust out there).

And again, I’d call all of these “high-risk.” I know I’ve been calling StrongBlock “medium-to-high risk” in the previous post, but I feel better about simply calling it “high-risk” now to really emphasize that it should only represent a small part of your portfolio (and, it could implode at any time). More on this in a minute.

To be completely transparent here, I want you to know that I haven’t personally done as much research as I probably should for the others on that list beyond StrongBlock and OlympusDAO. So, this order is mostly based on how many people I respect in this space I see talking about each one.

There’s also a lot of overlap across each of these communities. For example, it’s common for people to start out in OlympusDAO (or one of those other ones) to compound their money for a while, then buy a StrongBlock node once they’ve saved up enough.

I also want to stress for all of these that everything depends on the price of the underlying token.

It doesn’t matter how many StrongBlock nodes you have if the price of STRONG drops dramatically. It doesn’t matter how much you have staked in OlympusDAO if the price of OHM drops dramatically. And even if a liquidity staking or yield farming opportunity on a DEX has been returning a high APY, that doesn’t matter if the token you’re receiving the rewards in drops substantially.

For example, I was doing great in the Auto CAKE pool on PancakeSwap for months, and the high APR never really changed. But, over time, the price of CAKE (which the rewards were delivered in) steadily declined until all my profits were gone and I ultimately ended up with less money than I’d originally put in.

I don’t have an easy solution here, but I simply want to warn you to pay close attention to what type of rewards you’ll be getting in whichever strategy you’re attempting, and to ask yourself how stable that token is likely to be. In the case of CAKE, I imagine that the price has been steadily declining because it’s on the Binance Smart Chain and a lot of people in the crypto community don’t like that that chain is so centralized (since it’s controlled by the for-profit company Binance).

Also, as we covered in Part 18, keep a close eye on market caps too. With StrongBlock for example, the team has been very careful to limit the total supply of STRONG so that it remains valuable. In contrast, other projects are released with way too high a number of their token, or even no cap on the supply, so the price of those tokens is much less likely to stay steady.

Update on OlympusDAO:

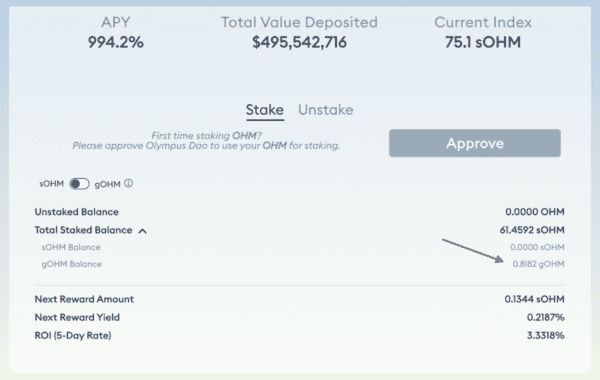

The price of OHM (the token behind OlympusDAO) has been dropping dramatically over the past month (December and January). This is a great example of how, even though the APY has been high (nearly 4,000%) throughout, the value of my investment has been cut in half because the underlying token declined so much. So, this is why you can’t necessarily expect super high returns in anything in crypto simply because a high APY is promised.

Is OlympusDAO still a good investment? I’m not sure. Like I said in Part 20, OlympusDAO has always been a risky play that’s complicated to understand. The consensus in the community seems to be that the dip has been due to a combination of (1) the decline in the overall crypto market, (2) the transition to version 2 of the OlympusDAO platform, and (3) the fact that the amazingly high APY had attracted a lot of people new to crypto and investing who didn’t understand the risk involved and panic-sold as the market began to drop.

It seems like the fundamentals of the project are still solid though, and they’ve attracted partners to their Olympus Pro offering (i.e., helping other projects adopt the bond model that makes OlympusDAO unique). As of now, I’m personally intending to hold my position for the medium-term at least. However, if I had to choose between going into OlympusDAO or StrongBlock, I would choose StrongBlock.

Also, as I mentioned in Part 20 as well, the DeFi yield farming world moves very quickly, and a lot of savvy people were already shifting their investments from OlympusDAO to Tomb Finance. Since then, TOMB has certainly outperformed OHM. So again, if you’re going to invest in these high-risk opportunities, it’s important to keep up-to-date with what’s going on in this world. You can’t just put your money in and check back in six months.

1/30 Update:

By the way, back in December, OlympusDAO announced that the platform was going to be updating to a new version, and all stakers had to migrate their tokens from sOHM (i.e., staked OHM) to the new token gOHM. If you haven’t migrated yet, you should do so ASAP before the old tokens stop earning APR. Make sure you wait till gas fees are low, though.

Here’s how to check if you still need to migrate: Log into the OlympusDAO dapp, and you’ll probably see a big “migrate” message if you haven’t migrated. If you don’t see that message, you can double-check by clicking Stake on the left, then expanding your Total Staked Balance. In there, you should see 0 for sOHM and a non-zero value for gOHM, like this:

Update on StrongBlock:

1/27 Update:

As I explained in the previous post on StrongBlock, I’ve always had a nagging feeling that something didn’t fully make sense with the StrongBlock project.

I was struggling to understand the sustainability and tokenomics issues, and I was confused about whether or not StrongBlock does in fact make real full-nodes or if they’re something else like “RPC nodes” that might not actually be fulfilling the project’s stated mission of making the blockchain more resilient.

Nothing has dramatically changed here since that post, but I’ve done even more research into “RPC nodes” and spoken to a few more people who have more technical expertise in how blockchains work.

I still think that StrongBlock might be an ok investment as long as it represents only a small percentage of your portfolio; but, I feel more comfortable at this point referring to it as a “high-risk” investment rather than a “medium-to-high risk” one as I did in the previous post.

Here’s some of what I’ve heard that’s made me a little more dubious about StrongBlock:

(Keep in mind that these are just the thoughts and speculations of me and a few other people, and there are many thousands of other people in the StrongBlock community happily creating more nodes every day without worrying about this):

- An RPC endpoint is a way for a computer or a dapp to connect to the blockchain. More specifically, RPC stands for Remote Procedure Call, and it’s a type of API (or, method of communication) allowing developers to remotely execute code on a server.

- In MetaMask, you can hit the “Ethereum Mainnet” dropdown then “Add Network” to use a custom RPC rather than the default one. That’s how you typically set up your MetaMask to connect to other blockchains like Polygon or Fantom. It’s also how you can test that StrongBlock nodes are in fact doing something—by clicking on your node in the StrongBlock dapp, you can copy its RPC endpoint and enter that into MetaMask, then you can connect to the Ethereum blockchain through that.

- One question here, though: Does that prove that each StrongBlock RPC endpoint is in fact pointing to a real full-node, or could they be using some trickery to route you to a server shared by many StrongBlock “nodes”?

- Why might we be paranoid enough to imagine that? Because it typically costs several hundred dollars a year to run a virtual Ethereum full-node, but StrongBlock only charges us $15/month to keep each of our nodes running. To be fair, though, it’s possible that some of their engineering work and operating at this level of scale has allowed them to reduce the cost of running nodes on their end.

- Is it possible that StrongBlock might be able to sell or lease the nodes to development teams? Possibly, since connecting your dapp through more secure, faster, reliable nodes can boost its performance. However, it doesn’t seem like any teams have actually taken them up on that service.

- Again, the real question is about sustainability. StrongBlock has already created a huge number of nodes, and if people keep compounding their rewards into more nodes, that number will keep increasing exponentially.

- And even if StrongBlock expands to other blockchains, it’s not clear that those chains need more nodes. More importantly, those exponential nodes are going to keep spitting out STRONG, and as the community keeps cashing out more and more of it, it’s bound to drive the price of STRONG down.

So, all that leaves me thinking there are two possibilities:

- The team is deceiving us about the true utility of the nodes, and they know that none of this is sustainable. In this case, it’s probably not a rug-pull scam exactly (i.e., there might not be any moment where everything suddenly changes); but, it might be more like they’re just enjoying collecting our fees for as long as that lasts (i.e., for as long as all the node owners are willing to keep paying those fees).

- StrongBlock is indeed creating real full-nodes with real utility, the team still believes in the mission, and they’re working hard to figure out how to fix the sustainability issue and do something with all those nodes. The community just isn’t aware what that is yet. The StrongBlock team even released this brand new short video a couple of days ago that makes everything seem legitimate and mission-focused.

I’m honestly not sure which of those is more likely at this point. And, even if #1 is false, the team still needs to come up with some legitimate ways of making money soon; otherwise, even though the project is still getting new users every day, the whole thing is likely to collapse once enough people realize it’s not sustainable.

So, what I would say is: Enjoy StrongBlock while it lasts, but please consider it high-risk and limit your investment size accordingly.

I’m not saying that this is all going to fall apart tomorrow. But, if the team doesn’t announce a better sustainability plan soon, I personally wouldn’t count on StrongBlock lasting more than, say, 6 more months (which I’m saying out of a pure gut-based guess, no real math involved).

So, if you’re entering for the first time now, you might consider going for a Polygon node rather than an Ethereum one since, that way, you’ll make back your investment sooner. That’s what I would do if I were deciding to buy my first node today.

This is a good time to talk briefly about investment psychology.

I’m sorry if this feels like a betrayal for me to be urging even more caution here after devoting a whole post to StrongBlock so recently. But this might be a great opportunity for you to examine how your mind operates when faced with exciting investment opportunities.

I invite you to notice: When you read or listened to my last StrongBlock post (where I explained how I’d been receiving a consistent 350% APR), was your response more like, “Wow, I better buy as many nodes as I can ASAP” or more like, “Interesting, this seems worth investigating, but Michael also said it’s risky, so I better not put too much money in here”?

I don’t mean for that to sound patronizing, but I know how easy it is for all of us (myself included) to get overly-excited about risky investment opportunities. So this is a reminder that (a) “high-risk” means that you could lose everything you invest, and (b) the crypto world changes very quickly, so it’s not safe to be complacent if you’re investing in risky opportunities.

Especially with complex opportunities like StrongBlock whose precise technical functionality is not 100% clear, please don’t be satisfied with just one person telling you it’s a good investment. Please do your own research, make up your own mind, and only invest enough that it won’t hurt you too badly if you lose it all.

And again, this whole StrongBlock update is just my opinion (which I still don’t feel completely sure about)—a lot of people still believe in StrongBlock more than ever. I’m just generally a fairly risk-averse person, so I wanted to be absolutely clear with you that I felt good about getting into StrongBlock when I did eight months ago, but I would feel less certain about getting in today.

That said, I want to be clear about one other fact: My feelings about StrongBlock have oscillated regularly over the past eight months. Ever since I invested (and leading up to that, really), I’ve had periods where I’ve felt more confident (and wanted to buy a lot more nodes) and periods where I’ve felt less confident (and worried that all the money I’d put in would surely soon be lost when the project imploded shortly).

So, what I’m feeling now isn’t dramatically different from, say, six months ago. Obviously if I’d decided to remain completely risk-averse back then, I would have missed out on many thousands of dollars of profit.

This time does feel a bit different since I’ve done so much research about the project and the sustainability problem still doesn’t make sense to me (and it seems to be getting worse). But, I also remember a similar feeling a few months ago before the Polygon nodes launched: feeling like a fool for trusting the team to deliver on that promise when that feature kept being delayed.

On balance then, I invite you to make up your own mind. I don’t want to scare you away since this could very well still be a good investment at this point. All I can tell you is that I personally would be wary right now given all the information that I’ve laid out here.

Best of luck with your decision 🙂

By the way, if you are invested in StrongBlock or about to get in, here’s a tip I just learned recently:

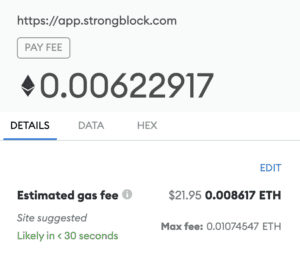

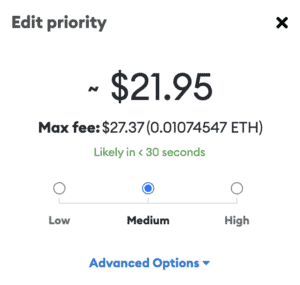

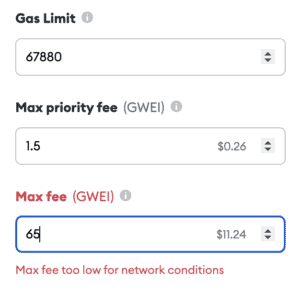

Since the gas fees can add up quickly when you’re paying StrongBlock maintenance fees, claiming rewards, and creating nodes, there’s an easy way to save yourself money there.

Here’s how:

- Look up historical gas fees and find the lowest gwei numbers over the past few days, then add a little to be safe (e.g., at the time of writing, it’s been dipping down as low as the high 50’s lately in the very early morning, so I’ll pick a low of 65 to be safe).

- (Remember that “gwei” is what gas is measured in and it represents a small fraction of an ETH.)

- On the StrongBlock dapp, move forward with whatever type of transaction as usual; then, when MetaMask pops up to confirm, there’s one setting to adjust: Right above where it says “Estimated gas fee,” click the “EDIT” button, then “Advanced Options,” then change “Max fee” to 65 (or whatever your number is). Be careful: Don’t change the “Gas Limit” number, only the “Max fee.” Also, it’ll probably tell you that your max fee is too low, but you can ignore that.

What this will do is hold your transaction in limbo until gas fees drop down to that level, usually in the middle of the night or in the early morning; then, it’ll execute. So, you can set this up at night before going to bed, and when you wake up it should be finished. If it’s not, you’ll probably have to find your in-progress transaction in MetaMask’s activity tab and increase the max fee.

Ok, let’s wrap up those seven investment categories by putting them into perspective across some subjective levels of risk:

- Very low risk:

- Earn yield on stablecoins in CeFi (e.g., Crypto.com, Nexo)

- APR: Under 10%

- Low risk:

- Earn higher yield on stablecoins in DeFi (e.g., Anchor Protocol, Yearn)

- APR: 10-20%

- Low-medium risk:

- Buy & hold or stake trustworthy coins and tokens (e.g., ETH, DPI)

- APR: Highly variable depending on the coin or token and what the overall market is doing, but you might potentially get 50-100% or more if you pick the right ones

- Medium risk:

- Liquidity stake and yield farm on trusted single-sided liquidity DeFi platforms (e.g., PancakeSwap, Bancor)

- APR: 40-80%

- Medium-high risk:

- Liquidity stake and yield farm on DeFi platforms with risk of impermanent loss (e.g., Uniswap, SpookySwap)

- APR: 50-300%

- High risk:

- Create nodes on StrongBlock or stake on OlympusDAO or Tomb Finance

- APR: 300-1,000%

- Extreme risk (in other words, “ridiculous level of risk for anything but a tiny fraction of your money”):

- Stake on one of the many OlympusDAO clones and similar opportunities that haven’t even been audited by a third-party

- APR: Potentially many thousands of percent (but, that APR might dry up in weeks or even days after the project launches)

As always, my recommendation is to have a mix of various risk levels in your portfolio. Most of your money should probably be in the lower and medium risk levels with only a portion in the higher risk levels. And, if you’re going into extreme risk territory, you should probably use a separate wallet altogether.

Remember too what I explained in Part 18: That many DeFi platforms by default will request unlimited or infinite access to a cryptocurrency of yours. So, it’s important to regularly check which platforms you’ve given that kind of access to. I’d suggest revoking access when you’re done transacting with a platform unless you use it regularly—for example, to keep reinvesting your rewards. You can see and revoke your allowances on Debank (go to Profile, then Approval) or Etherscan.

In my case, I generally check those websites every few weeks to see which platforms I’m not using right now and then revoke their access. But, keep in mind that each of those changes costs gas, so that’s why I only do it every few weeks. I’m also experimenting often with many new platforms, so you might only need to do this every few months, or even less often.

Also, it’s most important to do this with coins or tokens that might be used by multiple platforms, like ETH, and only with coins or tokens that you have a lot of in your wallet. If you only have a little of a coin or token, it’s probably not worth the gas fee to revoke access to it.

Finally, when you’re considering your risk allocation, keep in mind that it should apply to your entire net worth. So, outside crypto, if you have money in, say, riskier stocks versus safer bonds, that should affect what level of risk you take on here. In other words, your risk allocation should take into account all your investments.

Next time, I’ll share where my money is, how much I’ve made, and some thoughts on how you might approach crypto investing depending on your level of wealth.

P.S. Crypto is one of my newest passions, but my overarching focus in life is personal growth and intentional living. Do you want help with challenges like confidence, decision-making, or idea overwhelm? I’m a transformation coach who helps analytical thinkers get unstuck, find consistent motivation to take action, and design their life purpose. Read more about me here or my coaching practice here.